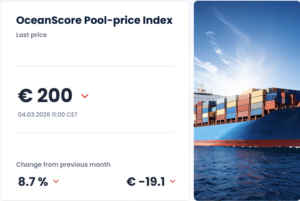

OceanScore has launched a new planning, simulation and budgeting tool for optimising compliance with FuelEU Maritime from a commercial standpoint. Its FuelEU Planner is the first in a suite of solutions geared to supporting complex decision-making processes with the upcoming regulation.

The company unveiled the FuelEU Planner at a launch event for more than 150 clients and stakeholders in Hamburg this week, coinciding with the SMM conference and exhibition where FuelEU Maritime was a hot topic of discussion as its implementation looms on 1 January 2025.

The attendance at the event reflected the high level of interest in the latest application to be launched by the maritime solutions and data firm to simplify the increasing complexities of regulatory compliance. This follows its market-leading ETS Manager geared towards the EU Emissions Trading System (EU ETS) that was launched a year ago.

Modelling different scenarios

The FuelEU Planner is a web-based solution that allows shipping companies to evaluate the various options for reducing GHG intensity, vessel optimisation and managing the remaining compliance balances. It is able to simulate different operational and investment decisions to be taken and compare these simulations from a total cost of ownership perspective.

“FuelEU adds another layer of regulatory complexity for the industry beyond the EU ETS as it entails difficult choices for shipping companies related to fuel selection and low-carbon technology investments, as well as management of compliance balances,” says OceanScore Managing Director Albrecht Grell.

“FuelEU’s commercial impact also differs significantly from the EU ETS based on the decisions taken by the shipping company – all the way to actually creating additional revenue and cost-saving opportunities.”

Costs and opportunities

The latest regulation, geared to promoting uptake of alternative fuel technologies, will require progressive reductions in the average well-to-wake GHG intensity of energy used by ships above 5000GT versus a 2020 baseline of 91.16 gCO2e per MJ, rising from 2% next year to 80% by 2050, with a penalty of €2400 per tonne of VLSFOe for non-compliance.

OceanScore has calculated that shipping would face total FuelEU penalties of €1.345 billion in 2025, based on data on trading patterns and fuel mix from 2022 for some 13,000 vessels over 5000gt that are liable to the regulation. The company is forecasting though that the current rapid uptake of biofuels will lead to a balanced compliance market, where compliance surpluses will balance compliance deficits.

FuelEU introduces new concepts such as banking, borrowing and pooling of compliance surpluses or deficits and different metrics like well-to-wake and energy measurement in megajoules (MJ), contributing to the complexity of decisions to be made but also to the opportunities made available through this regulation.

Impact on compliance balance

Based on these parameters, OceanScore’s FuelEU Planner is able to simulate the effect of different fuel and investment strategies on a per-vessel and per-fleet basis to determine the impact on compliance balance and total cost so that companies can effectively plan bunker procurements and future operations for budgeting purposes and charter parties for 2025 and beyond.

The solution also facilitates discussion of how compliance balances should be handled in terms of either paying penalties, borrowing and pooling in the case of deficits, or banking and pooling in the case of surpluses.

Fuelling interest

OceanScore, which now has further products in its FuelEU suite on the launchpad, is already seeing increasing industry uptake of the FuelEU Planner, with heavyweight MSC among the first clients to sign up for the solution, taking a proactive approach to the new regulation.

“It’s important to not just see FuelEU as just another cost and administrative burden but to understand and proactively manage the resulting opportunities. Our planner is the most advanced solution to support the needed simulations as well as facilitating the necessary alignment between the different stakeholders in shipping,” Grell concludes.

For more information contact:

Candice Buckle, Marketing Manager, OceanScore.

Email: candice.buckle@oceanscore.com

About OceanScore

Founded in 2020, OceanScore is a global provider of compliance and data solutions for the maritime industry with office locations in Germany, Poland, Portugal, and Singapore. Its suite of digital platforms and services is designed to support shipping to successfully navigate emissions regulation, facilitating the industry’s transformation towards sustainability. Beyond emissions, OceanScore tracks sustainability, environmental, and reliability of over 130,000 vessels globally, serving the wider maritime ecosystem.