OceanScore reviews the first year of EU ETS: what have we learned and what lies ahead?

OceanScore says many shipping companies struggle to track whether invoices have been accepted, EUAs delivered or payments made without a centralized system.

OceanScore client Hammonia Reederei states: “As a high-quality third-party manager, transparency is at the core of how we work with our customers – no hidden charges, no hidden fees. Managing ETS exposure across multiple owners and charterers is a complex task, but OceanScore’s ETS Manager has made it efficient and straightforward. Their solution not only streamlines our processes but also helps us provide clear, transparent cost breakdowns around ETS compliance to our customers, reinforcing our commitment accountability to trust and accounting.

Looking ahead, Grell says “temporary solutions may suffice for now in tackling some of these challenges, but they are not sustainable long-term”, especially with implementation of FuelEU from next year that he believes will amplify pressure for automated data-driven systems to cope with the complexity.

“The lessons from these challenges highlight the need for systematic, scalable solutions to manage emissions compliance effectively, ensuring long-term success under the EU ETS framework. The growing need for robust tools is clear. Transparency, efficiency and collaboration across stakeholders will be crucial to tackle the challenges ahead,” he concludes.

UK eyes expanding its ETS to deepsea shipping – closing EU loophole

Apart from the hit to the EU’s decarbonisation goals, OceanScore MD Albrecht Grell said the UK loophole would tie-up ship capacity, inflate freight rates and could cause disruption as carriers queue up at UK ports.

“We need to consider that UK ports do not have the capacity to handle significant increases in throughput, so more port congestion, time lost, would have to be considered,” he said.

Mr Grell added that he did not expect the loophole to last for long at any rate, as the EU is planning to review its ETS from 2026.

OceanScore supports tricky bunker selection process under FuelEU Maritime

“Fuel selection is the most important lever under FuelEU,” said OceanScore Managing Director, Albrecht Grell. “Your choice of fuel can either create a surplus or a deficit in your compliance balance, directly affecting your costs.”

Grell added: “Choosing the right fuel can help avoid penalties and even create revenue by pooling surpluses. But not all alternative fuels are the same, and their viability often depends on future pooling prices, which are hard to predict.”

FuelEU charts a course for reducing emissions in shipping, with a target near net-zero by 2050. For now, two main options are available to meet the greenhouse gas (GHG) threshold of 89.3g CO2e/MJ until 2029:

LNG and LPG: These fuels, when used in dual-fuel engines, will meet the rules and can generate surplus compliance balances. However, their benefits will decline until 2040 as limits tighten.

Biofuels: These are a good option for most vessels. They are usually used in blends (eg. B20-B30) with conventional fuels. These blends will be compliant until 2040; higher blends or pure biofuels will be needed thereafter.

One issue is that EU ETS and FuelEU Maritime treat biofuels differently. Under EU ETS, biofuels are considered zero-emission, meaning companies do not need to buy carbon credits. But under FuelEU, the rules are stricter.

“FuelEU doesn’t count all biofuels equally,” Grell explained. “Fuels made from food or feed crops are treated like conventional fuels in terms of emissions. Only waste-based biofuels are fully compliant, and even then, their specific GHG values are above zero.”

This difference matters. Standard biofuels, such as those from rapeseed or sunflower seeds, still benefit from ETS discounts but fall short under FuelEU. For full compliance, waste-based biofuels are needed, such as those from used cooking oil or animal fat. Further complications are added when considering the different rules behind the 50% discounts applied to voyages to and from the EU under the two regulations.

OceanScore, which provides advanced solutions to facilitate efficient regulatory compliance, is assessing the impact of alternative fuels based on their relative carbon intensities, calorific values (LCVs), prices, and ETS cost incurred, reflecting these in its FuelEU Planner. The challenge goes beyond selecting fuels with low GHG intensity and factors such as the vessel’s ice class or whether voyages are intra-EU or international also influence compliance balance.

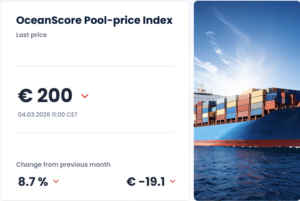

If companies bunker more expensive alternative fuels like biofuels, there is no guarantee it will always pay off. “FuelEU allows for pooling of compliance surpluses and deficits,” Grell added. “Surpluses generated by using compliant biofuels can be sold in the compliance market to vessels in deficit.”

OceanScore’s analysis indicates that the compliance market will be in surplus by 1 January 2025. “This surplus will put downward pressure on pooling prices, meaning it might be cheaper to buy a compliance surplus in the pool rather than generate it through compliant bunkering on your own vessels,” Grell said. “Both approaches would be compliant with FuelEU regulation and need to be considered at least from a commercial angle.”

Given this, any sound compliance strategy must look beyond fuel selection alone and consider the broader market dynamics. “Our FuelEU Planner integrates these variables into a comprehensive scenario simulation,” continued Grell. “This is crucial because tackling FuelEU successfully requires charterers, managers, and owners to collaborate using a shared, fact-based approach.”

Grell outlines several key steps for shipping companies to optimise their compliance strategies. First, they must gain a thorough commercial understanding of the economics of different fuels, considering their prices, LCVs, EU ETS costs, and the cost of pooling FuelEU compliance balances.

At the same time, the technical and operational feasibility of using biofuels across different vessels should be assessed. While tests so far indicate that biofuels can be used without significant issues, lingering concerns over engine compatibility and tank systems remain.

“Engine manufacturers need to give the green light, and bunker providers must be identified in key ports,” Grell noted. “For now, many companies focus biofuel usage on a smaller portion of their fleet to simplify operations and reduce risks.”

However, one of the biggest hurdles remains contractual. “How do you protect the DOC holder, who is responsible for penalties, from the fuel decisions of the charterer? How do you fairly share the costs of biofuels and the value of surpluses? And how do you manage uncertainties tied to deployment patterns and fuel accountability under FuelEU?” Grell asked.

Without clear contractual terms, companies risk major financial and operational pitfalls. “To align incentives across owners, managers, and operators, you need clauses in agreements like Shipman and Charter Parties,” he stated. “The ‘polluter pays’ principle is not embedded in FuelEU, so a robust data-driven understanding of the entire value chain is essential to avoid costly disputes.”

OceanScore’s FuelEU Planner provides a clear path through the complexity. By simulating fuel use, compliance costs, and pooling options, the tool enables companies to budget effectively and negotiate data-driven contracts.

“We make the complex FuelEU regulations easier to manage,” Grell concluded. “With our solutions, companies can understand the commercial impacts of their fuel choices, gain full transparency and confidently manage their compliance strategy.”

You might also like

Veolia, Enagás, and Barcelona City Council inaugurate first urban cold recovery network from LNG terminal

OceanScore calculates €175m potential costs for Greek shipping with FuelEU Maritime

Greek shipping companies are set to face a total bill of over €175m in penalties incurred under FuelEU Maritime after it takes effect next year but can also capitalise on the use of alternative fuels both to curb their financial exposure and generate compliance surpluses, according to OceanScore.

OceanScore Pulls Crowd with Launch of FuelEU Planner Amid SMM

OceanScore has launched a new planning, simulation and budgeting tool for optimising compliance with FuelEU Maritime from a commercial standpoint. Its FuelEU Planner is the first in a suite of solutions geared to supporting complex decision-making processes with the upcoming regulation.

OceanScore closes €5m funding round to speed up global expansion and product innovation

OceanScore, global provider of data and compliance management solutions for the maritime industry, has successfully closed an oversubscribed €5 million Series A financing round. The influx of new capital will enable the company to further develop its solutions portfolio and expand its global footprint.

Shipping Faces €1.345bn In FuelEU Penalties In 2025

The upcoming implementation of FuelEU Maritime has shipping companies on high alert due to potential penalties for non-compliance with greenhouse gas (GHG) intensity reduction targets, says the Hamburg-based provider of compliance and data solutions, OceanScore.

OceanScore inaugurates new office in Singapore

OceanScore has opened a new office in Singapore to serve its regional clients, responding to the growing demand in Asia for its digital solutions designed for efficient regulatory compliance with the EU ETS and FuelEU Maritime.

Shipping faces $1.46bn in penalties from next European carbon emission crackdown

Shipping could rack up €1.35bn ($1.46bn) in penalties in 2025 under the incoming FuelEU Maritime regulations, with a potential new market emerging for the sale and purchase of surplus energy volumes according to experts.

Container shipping will be hit hardest by upcoming FuelEU Maritime regulation

OceanScore has identified the segments set to be hit hardest. OceanScore forecasts that shipping as a whole will rack up total FuelEU penalties of €1.345bn in 2025 through analysis of the 13,000 vessels over 5,000 gt trading within and into the EU/EEA that are subject to the regulation.