OceanScore is seeing rapid uptake of its recently launched EU ETS management solution with over 50 shipping companies now signed up representing more than 1000 vessels – around 10% of the eligible fleet – as the clock ticks towards implementation of the regulation.

Industry heavyweights MSC and Döhle Group, as well as OKEE Maritime and many well-run smaller and medium-sized owners and managers, are among a growing crop of new clients for the company’s ETS Manager application following thorough testing of competing solutions.

OceanScore co-Managing Director Albrecht Grell said there is strong interest in the software platform from a wide range of ship owners, managers and operators that are seeking to navigate the complexity of the EU Emissions Trading System (EU ETS) as the 1 January 2024 deadline for phased implementation rapidly approaches.

“It is going to be an expensive and risky environment: the average vessel in the EU is expected to have to surrender carbon credits to the tune of €500,000 annually once the regulation is fully phased in by 2026,” Grell said.

End-to-end solution

The EU ETS will require shipping companies to have in place administrative systems to track CO2 and other emissions and determine the volume of EU Allowances (EUAs), or carbon credits, needed to cover these emissions. It will also be necessary to assign the costs of EUAs to stakeholders across the value chain to manage financial liabilities.

“Every manager and owner will need to make sure that they are not left to procure EUAs that the vessel’s operator should have provided. That is the number-one risk to mitigate,” Grell explained.

ETS Manager is designed to meet the main challenge of the regulation by establishing efficient and transparent processes between owners, managers and charterers to manage EUAs and maintain control of ETS costs and related risks. By incorporating the EUA Trader solution powered by RWE Supply & Trading, OceanScore’s ETS Manager functions as an efficient end-to-end solution.

According to OceanScore co-Managing Director Ralf Garrn, the Hamburg-based maritime technology firm has signed up around 10% of the approximate 11,800 vessels that will be liable for their emissions under the EU ETS, which will initially apply to cargo and passenger ships over 5000gt with liabilities rising from 40% of emissions in 2024 to 70% in 2025 and 100% in 2026.

“We have seen a phenomenal rate of adoption of ETS Manager only a few months after its launch, having started onboarding clients in September when some of the regulatory elements – such as final responsibility for compliance – were still to be finalised,” Garrn said.

‘Market recognition’

“This high level of demand is indicative both of the sense of urgency in the industry and market recognition of the viability and credibility of ETS Manager, which has already been well proven through several pilot projects with clients.”

Döhle Group’s Finance and Corporate Development Director, Matthias Bloete, said: “We have looked at different approaches to manage our EU ETS exposure. OceanScore convinced us not only with their workflows; their service centre has proven to be extremely helpful. We know OceanScore’s team and feel comfortable using their software solution.”

MSC said in a statement: “In this current dynamic regulatory environment, we have found OceanScore to be a valuable tool to assist our efforts in ensuring an optimal balance between vessel performance and EUA allocation.”

OKEE Maritime’s Marnie Merillon stated: “Being a smaller shipowner, we had to look for an holistic and efficient solution to properly manage our emissions. We found the solution from OceanScore, partnering with StormGeo, to be best suited to prepare for the upcoming challenges on our path to a more sustainable and greener future.”

ETS Manager enables ship owners and managers to comprehensively manage and monitor the complete process from assessing the need for EUAs, allocating them to charterers or owners, requesting and accounting for them, and tracking open positions.

Reliable trading platform

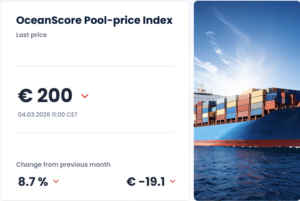

EUA Trader tracks the market price of EUAs and facilitates buying and selling of carbon credits on the RWE Supply & Trading platform through a simple, all online operation, with the ability to buy incremental volumes as needed and forward trading flexibility to hedge the risk of price changes.

Garrn said the need to buy EUAs for times to be covered by the owner and to surrender EUAs that should be provided by the charterer introduces a new element of risk with exposure to potentially huge liabilities for the vessel’s owner or the Document of Compliance holder, typically a ship manager if the transfer of ETS responsibility is agreed.

“Shipping companies need to select a reliable trading platform that can facilitate timely settlement of EUA transactions with third parties to minimise these liabilities,” Garrn said. “Integrating such a trading platform in the overall ETS management solution increases efficiency and reduces the risk of faulty entries.”

ETS Manager is undergirded by a network of third-party collaborations to support a smooth end-to-end process for emissions management, from securing good quality data at the outset to ensuring trustworthy EUA trading at the other end, according to Grell.

“It is very gratifying to see that our EU ETS management solution has hit a sweet spot in the market with an increasing number of shipping companies realising its potential value to their business both in managing compliance and mitigating financial risk from trading in EUAs,” Grell said.

“While we are stimulated by the tremendous response so far, we see this support as an obligation to continue to work on our ETS Manager full steam ahead, adding functions, features and APIs for the benefit of our partners,” he added.