OceanScore has opened a new office in Singapore that will enable it to better serve regional clients as the company sees rising Asian demand for its digital solutions geared towards efficient regulatory compliance with the EU ETS and FuelEU Maritime.

“Our list of global clients is growing steadily in line with the industry’s pressing need to navigate the complexities of these new regulations. Establishing a presence in this leading maritime hub allows us to cater more effectively for our clientele in this region,” says OceanScore’s Managing Director Albrecht Grell.

The new locale in the Lion City marks the latest expansion by the Hamburg-based maritime technology firm, which also has offices in Poland and Madeira, Portugal.

The office was formally opened on 30 July at a high-profile event attended by honorary guest Kenneth Lim, Assistant Chief Executive of the Maritime and Port Authority of Singapore, among other invited guests including representatives of OceanScore clients and the local shipping community.

“We are especially grateful to our client Blue Net Chartering and its Managing Director Fabian Oelze for being able to host our new office on its premises to facilitate this expansion,” says Grell, who hosted the event.

OceanScore Singapore: ‘Dedicated expertise on the ground’

OceanScore has recently appointed Leo Grayson as Head of Commercial APAC to lead the Singapore team. “By providing dedicated expertise and responsive service on the ground, we will be able to readily support regional clients with the resources they need to tackle their compliance requirements,” Grayson says.

OceanScore already serves dozens of shipping companies that have signed up for its web-based digital application ETS Manager, an end-to-end management solution for automated tracking, allocation, invoicing and accounting of EU Allowances (EUAs/carbon credits) to simplify complexity of commercial processes and mitigate risk related to the EU Emissions Trading System (EU ETS).

Among its clients are major shipping companies including MSC and Döhle Group, as well as Norbulk, Offen Group, Orion and Zeaborn Ship Management, with total coverage of more than 1000 vessels.

Grell says Singapore was selected as the next ‘port of call’ for the company due to its important strategic location for global shipping, with over 180 international shipping groups and around 4000 vessels registered there, as well as a strong sustainability-focused maritime cluster.

Singapore has again been named the world’s leading maritime city in the ‘2024 Leading Maritime Cities’ report from DNV and Menon Economics, and is expected to retain this title for the next five years due to its large owned and managed fleets, strategic geographic advantages, pro-business policies and leadership in the green transition.

Counting cost of EUAs

Located on the heavily trafficked Strait of Malacca, Singapore is one of the world’s busiest ports and serves as an important transit hub for ships plying the key trade route between East Asia and Europe that are now exposed to liabilities under the EU ETS, which requires 50% of emissions to be covered for voyages to/from the EU/EEA.

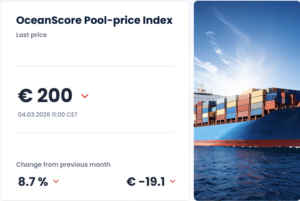

OceanScore now estimates a total EU ETS cost of nearly €400m for the 1120 liable vessels registered in Singapore once the regulation is fully implemented in 2026, based on a requirement for 5.5m EUAs and the current carbon price of €70 per tonne.

This accounts for around a third of €1.2 billion in total emissions liabilities for Asia-based players and roughly 7% of nearly 80 million EUAs to be surrendered by shipping globally, according to OceanScore.

“Singapore’s share of global EUAs is expected to rise around 3% annually, based on historic data modelling, and it is therefore important for shipping companies to get to grips with the EU ETS by having efficient administrative processes in place to gain control of EUA costs and mitigate their exposure, while also pursuing fleet decarbonisation measures,” Grell explains.

Getting ahead of regulation

A further compliance challenge is looming on the horizon for shipping with the introduction from 1 January next year of FuelEU Maritime that will require players to reduce the GHG intensity of vessel operations within stated targets versus a 2020 baseline, starting at 2% and rising from 2030.

Following rapid industry uptake of ETS Manager after its launch in 2023, OceanScore is now preparing to launch its suite of FuelEU solutions on 4 September. This will include the FuelEU Planner that will allow the user to monitor compliance balances, simulate different courses of action, assess the full commercial impact of different fuel choices, and prepare annual budgets.

“A salient feature is the ability to simulate different scenarios for modelling the total cost of measures related to FuelEU such as using alternative bunkers, taking shorepower or assessing wind-assisted propulsion,” Grell explains. “In addition, penalty mitigation measures such as vessel pooling, banking or borrowing can be assessed.”

And he concludes: “Having such data-driven infrastructure in place will be a necessity for players in Singapore and elsewhere in managing the cost implications and risks of the new regulation.”

For more information contact:

Candice Buckle, Marketing Manager, OceanScore.

Email: candice.buckle@oceanscore.com

About OceanScore

OceanScore is a maritime data analytics firm that specialises in providing advanced solutions for regulatory compliance and benchmarking of environmental performance, with offices in Hamburg, Poland, Portugal and Singapore.