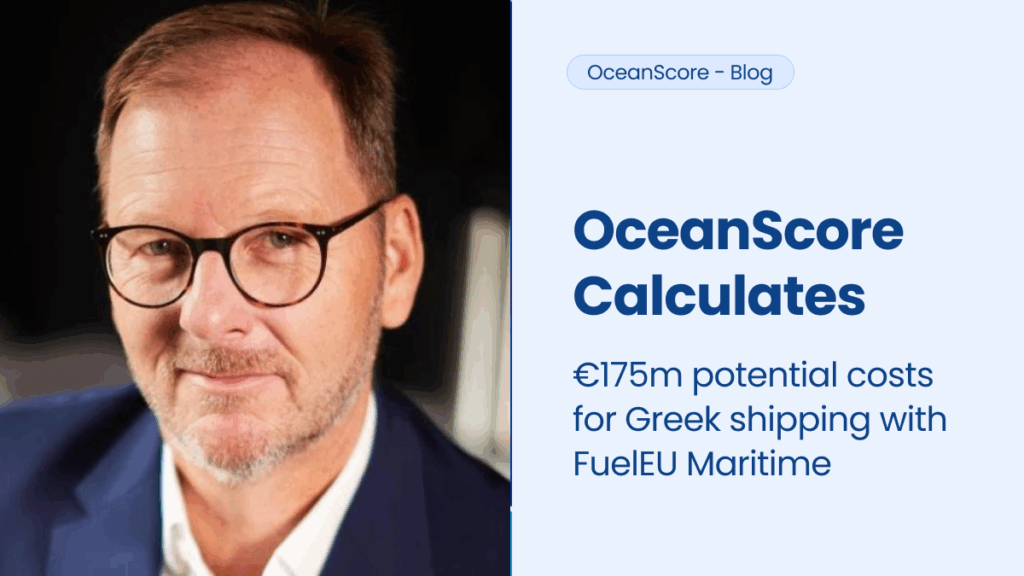

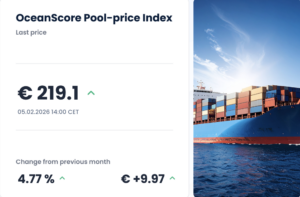

Greek shipping companies are set to face a total bill of over €175m in penalties incurred under FuelEU Maritime after it takes effect next year but can also capitalise on the use of alternative fuels both to curb their financial exposure and generate compliance surpluses, according to OceanScore.

The maritime solutions and data firm has calculated the prospective FuelEU exposure for over 370 Greek-registered companies based on the average GHG intensity of their past voyages.

Based on these calculations, OceanScore has determined the crude tanker, RoPax, bulker and containership segments would be hardest hit, with tankers accounting for €55m (32%) and RoPax €44m (25%) of potential penalties.

It has determined the top three shipping companies would be looking at a combined penalty of €25m, with the largest company facing the highest overall penalty of €11.75m and an average per-vessel penalty of €309,200, versus an average per-vessel penalty across all companies of €84,200. The second and third largest players would each have total penalties of around €6.5m.

Investments needed to offset compliance deficit

The overall Greek fleet of 2100 vessels would be left with a negative compliance balance, or deficit, of 71,666 tonnes of VLSFOe, according to OceanScore.

This is derived from a Greek fleet-wide average GHG intensity of 90.81g of CO2e per megajoule (MJ) of energy versus the initial FuelEU hurdle rate of 89.3g CO2e/MJ – a 2% reduction on the 2022 baseline of 91.16g CO2e/MJ that is the initial target from 2025-30 under the regulation.

However, OceanScore’s co-Managing Director Ralf Garrn says: “This should only be considered the starting point for Greek shipping and not the final scenario as much will depend on how companies take advantage of biofuels, low-carbon technologies and the FuelEU pooling mechanism to minimise their exposure.

“Vessels with a very high penalty structure will also gain the greatest beneficial effects from fuel switching with biofuels to reduce their penalties and can even convert these into opportunities by creating compliance surpluses that can generate revenue through pooling.”

LNG well-positioned to benefit

He highlights Greek LNG shipping operators as being especially well-positioned to capitalise on FuelEU due to a high compliance surplus that makes pooling opportunities attractive, given the use of LNG as fuel can cut emissions by around 25%. For example, two of the country’s largest LNG operators have respective surpluses of 82.1 tonnes and 45.2 tonnes of VLSFOe.

Garrn says the use of widely compatible biofuels probably represents the easiest option for most shipping companies to cut their carbon footprint in the short term. However, these are more expensive – at around €1300 per tonne of VLSFOe – than fossil fuels, while they also have a lower calorific value so a higher volume is required.

He explains that switching to biofuels to curb CO2 emissions would result in both savings on the current FuelEU penalty of €2400 per tonne of VLSFOe as well as reduced costs under the EU Emissions Trading System (EU ETS) due to the need to buy fewer EU Allowances (EUAs), or carbon credits.

OceanScore has calculated that Greek shipping presently has a requirement to purchase nearly 8.23m EUAs to meet its EU ETS liabilities, which would equate to €543m based on the current carbon price of €66 per tonne of CO2.

High potential for cost savings

The company cites the example of a containership that could achieve a total net saving of €1.3m versus the cost of paying FuelEU penalties by replacing HFO with rapeseed-based biofuel costing €1200 per tonne. It estimates this would give a beneficial financial impact of €241 per tonne in FuelEU penalty savings and €55 per tonne in EU ETS savings.

Furthermore, this could generate a compliance surplus of 973 tonnes of VLSFOe by reducing GHG intensity to 82.44g CO2e/MJ, which could be pooled externally to earn €2.3m in revenue or used to offset 43,000 tonnes of under-compliance in the internal fleet.

OceanScore has now launched its FuelEU Planner – the first in a suite of solutions set to be rolled out over the next year – that enables shipping companies to simulate different operational and investment scenarios to assess their commercial impact in relation to FuelEU compliance.

“This tool is designed to facilitate optimal decision-making by providing visibility on potential cost-saving opportunities as an alternative to simply paying penalties as we help the industry navigate the significant complexity of this regulation,” Garrn concludes.

For more information contact:

Candice Buckle, Marketing Manager, OceanScore.

Email: candice.buckle@oceanscore.com

About OceanScore

Founded in 2020, OceanScore is a global provider of compliance and data solutions for the maritime industry with office locations in Germany, Poland, Portugal, and Singapore. Its suite of digital platforms and services is designed to support shipping to successfully navigate emissions regulation, facilitating the industry’s transformation towards sustainability. Beyond emissions, OceanScore tracks sustainability, environmental, and reliability of over 130,000 vessels globally, serving the wider maritime ecosystem.