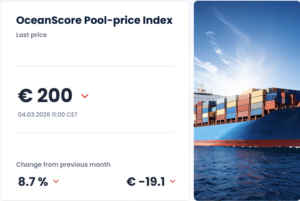

Implementation of the EU ETS for shipping from 1 January 2024 entails new regulatory complexity and financial risk with significant liabilities for the industry due to the requirement for shipping companies to purchase carbon credits to compensate for their annual emissions.

This presents a new set of challenges for shipping companies such as determining who is responsible for compliance with the EU ETS, who should pay for emissions, what contractual obligations need to be in place, data-handling and verification procedures, how to procure carbon credits, what trading platform to use and how to allocate costs across the value chain.

In order to navigate these myriad complexities, administrative systems need to be set up with digital automation of the various processes to effectively manage and mitigate the risks and ensure efficient compliance with the regulation, given non-compliance can incur heavy financial penalties or even an EU trading ban for an entire fleet.

OceanScore has been supporting dozens of partners in efficiently managing compliance with this regulation and securing end-to-end transparency to limit the inherent risks. In this series of blogs, we share some of our insights for EU ETS best practice to clarify the steps required.

While not definitive, as the diverse nature of shipping requires a tailored approach, it is intended as a useful guide to help companies define their EU ETS strategy and avoid some of the pitfalls on the difficult path to compliance.