Insights, Updates, and Maritime Trends

Welcome to the OceanScore Blog, your source for the latest updates, thought leadership, and industry trends in maritime compliance and sustainability. Stay informed with expert insights and company news shaping the future of the shipping world.

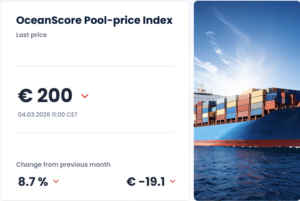

OceanScore Pool-Price Index Market Commentary: March 2026

OPX dropped to €200 per tCO₂e in March, the lowest level since September 2025. Increasing surplus supply and limited deficit demand are reshaping pricing dynamics in the FuelEU pooling market.

What Is the Environmental Ship Index (ESI) and How Does It Work?

How can environmental performance translate into commercial value? The Environmental Ship Index (ESI) provides a harmonised framework that allows ports…

FuelEU Pooling in 2026: From Commercial Agreement to Verified Compliance Process

FuelEU pooling in 2026 is no longer just a commercial agreement. Surplus transfers must be formally reported, approved by all…

OceanScore Pool-Price Index Market Commentary: February 2026

After compliance balances were closed at year-end, additional 2025 surplus volumes were released to the market in January. This increase…

FuelEU Maritime Forecasting: Managing Compliance Exposure Before It Becomes a Cost

FuelEU Maritime exposure develops continuously throughout the year. This article explains how compliance forecasting helps shipping companies manage cost, risk,…

EU ETS and FuelEU Compliance: The Hidden Risk of Manual Invoicing

Manual invoicing under EU ETS and FuelEU Maritime can quietly block cost recovery. See how one Greek owner-manager safeguarded €2–3…

OceanScore Pool-Price Index Market Commentary: January 2026

FuelEU pooling prices declined in January 2026 as surplus volumes increased following completion of the first compliance period. OceanScore’s OPX…

EU ETS and FuelEU Compliance Risk When Compliance Depends on One Person

When EU ETS and FuelEU compliance depends on a single individual, commercial risk increases quickly. This real case from a…

EU ETS and FuelEU Compliance: How One Ship Manager Regained Commercial Control

EU ETS and FuelEU compliance is no longer a side process. For shipping companies, it now directly affects cash flow,…

Maritime Compliance in 2026: What Commercial and Technical Teams Need to Prepare For

2026 will be a decisive year for maritime compliance. As FuelEU Maritime completes its first compliance cycle, EU ETS reaches…

OceanScore Pool-Price Index Market Commentary: December 2025

With the ability to generate additional surplus limited by the approaching year-end, and demand picking up, prices for pooling edged…

UK ETS Maritime: Preparing for a Confirmed 1 July 2026 Start

The UK Emissions Trading Scheme (UK ETS) for maritime is now confirmed to launch on 1 July 2026, introducing new…

EU ETS and FuelEU Maritime: Challenges and Opportunities for Asian Shipping

Asian shipowners face unique challenges as EU ETS and FuelEU Maritime take full effect. Fewer European voyages, complex Union Registry…

No More Spreadsheets. No More Guesswork.

Invoice charterers or owners with precision and confidence.

Latest Posts

OceanScore Pool-Price Index Market Commentary: March 2026

OPX dropped to €200 per tCO₂e in March, the lowest level since September 2025. Increasing surplus supply and limited deficit…

What Is the Environmental Ship Index (ESI) and How Does It Work?

How can environmental performance translate into commercial value? The Environmental Ship Index (ESI) provides a harmonised framework that allows ports…

FuelEU Pooling in 2026: From Commercial Agreement to Verified Compliance Process

FuelEU pooling in 2026 is no longer just a commercial agreement. Surplus transfers must be formally reported, approved by all…

OceanScore Pool-Price Index Market Commentary: February 2026

After compliance balances were closed at year-end, additional 2025 surplus volumes were released to the market in January. This increase…

FuelEU Maritime Forecasting: Managing Compliance Exposure Before It Becomes a Cost

FuelEU Maritime exposure develops continuously throughout the year. This article explains how compliance forecasting helps shipping companies manage cost, risk,…

EU ETS and FuelEU Compliance: The Hidden Risk of Manual Invoicing

Manual invoicing under EU ETS and FuelEU Maritime can quietly block cost recovery. See how one Greek owner-manager safeguarded €2–3…

OceanScore Pool-Price Index Market Commentary: January 2026

FuelEU pooling prices declined in January 2026 as surplus volumes increased following completion of the first compliance period. OceanScore’s OPX…

EU ETS and FuelEU Compliance Risk When Compliance Depends on One Person

When EU ETS and FuelEU compliance depends on a single individual, commercial risk increases quickly. This real case from a…

EU ETS and FuelEU Compliance: How One Ship Manager Regained Commercial Control

EU ETS and FuelEU compliance is no longer a side process. For shipping companies, it now directly affects cash flow,…

Maritime Compliance in 2026: What Commercial and Technical Teams Need to Prepare For

2026 will be a decisive year for maritime compliance. As FuelEU Maritime completes its first compliance cycle, EU ETS reaches…

The OceanScore Pool-Price Index (OPX) for 2025 compliance surplus now stands at €200 per ton of CO₂e, down from €219 in February.

Read the latest OPX commentary to understand the market movement and implications for FuelEU pooling.