FuelEU Pooling Marketplace

Trade Surplus, Avoid Penalties, Stay Compliant – The Smart Way.

Pooling today is far cheaper than paying the penalty (€640/t CO₂e) and easier than sourcing and securing biofuels. OceanScore’s Pooling Marketplace connects you directly with surplus providers, giving you full market visibility and flexibility.

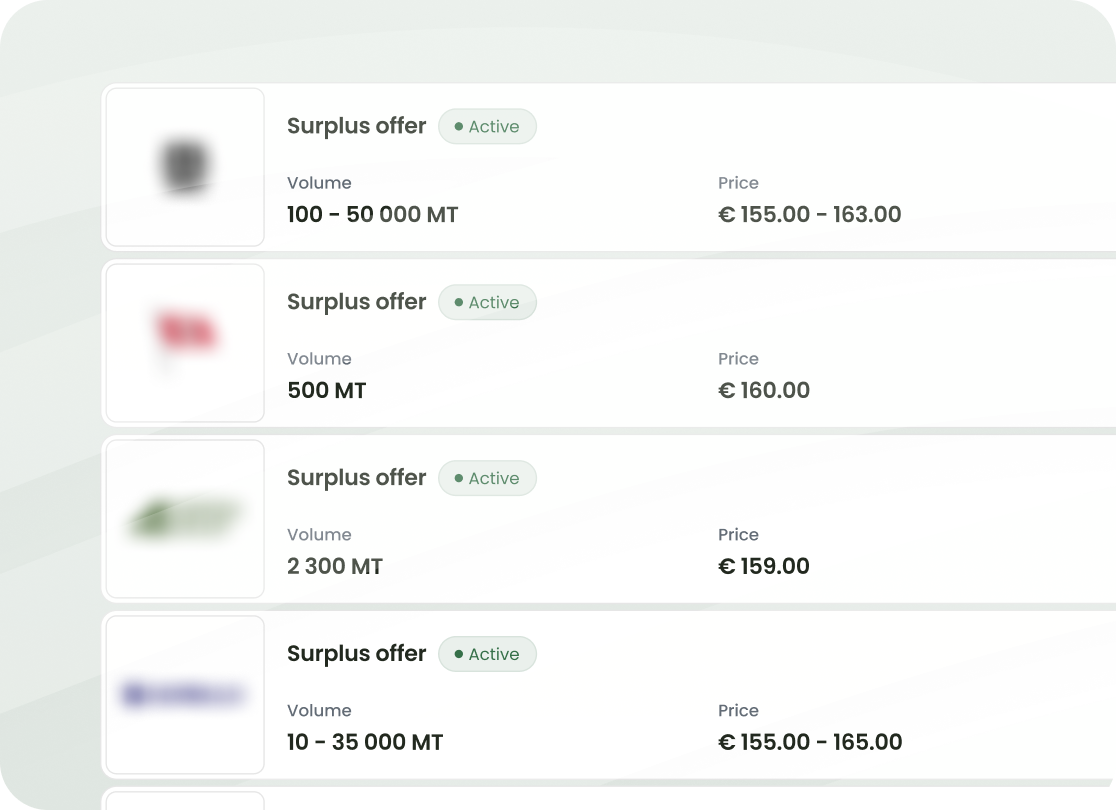

Easy search for and comparison of surplus offers

Competition between providers ensures you get the best terms

No hidden transaction fees and no lock-in. Just a small onboarding fee

Backed by the largest FuelEU relevant client base in the industry

TRUSTED BY OUR CLIENTS AND PARTNERS

Why FuelEU Pooling Matters

The Timeline

- Reporting period closes: 31 December 2025

- Verified balances published: March 2026

- Official pooling window: 1–30 April 2026

The Opportunity

- Secure partners early and lock in today’s prices

- Bank surplus for future years

- Resell excess or top up deficits in April

- Avoid technical risks and sourcing challenges of biofuels

- Gain compliance options even if you don’t control fuel choice

OceanScore’s Pooling Marketplace offers a smart, flexible way to pool

Simplify Compliance With The OceanScore Pooling Marketplace

Market Access, Made Easy

- Lowest cost of compliance – Pooling today costs less than one-third of the FuelEU penalty.

- Simplicity – No sourcing headaches, no change-over risks, no operational disruption.

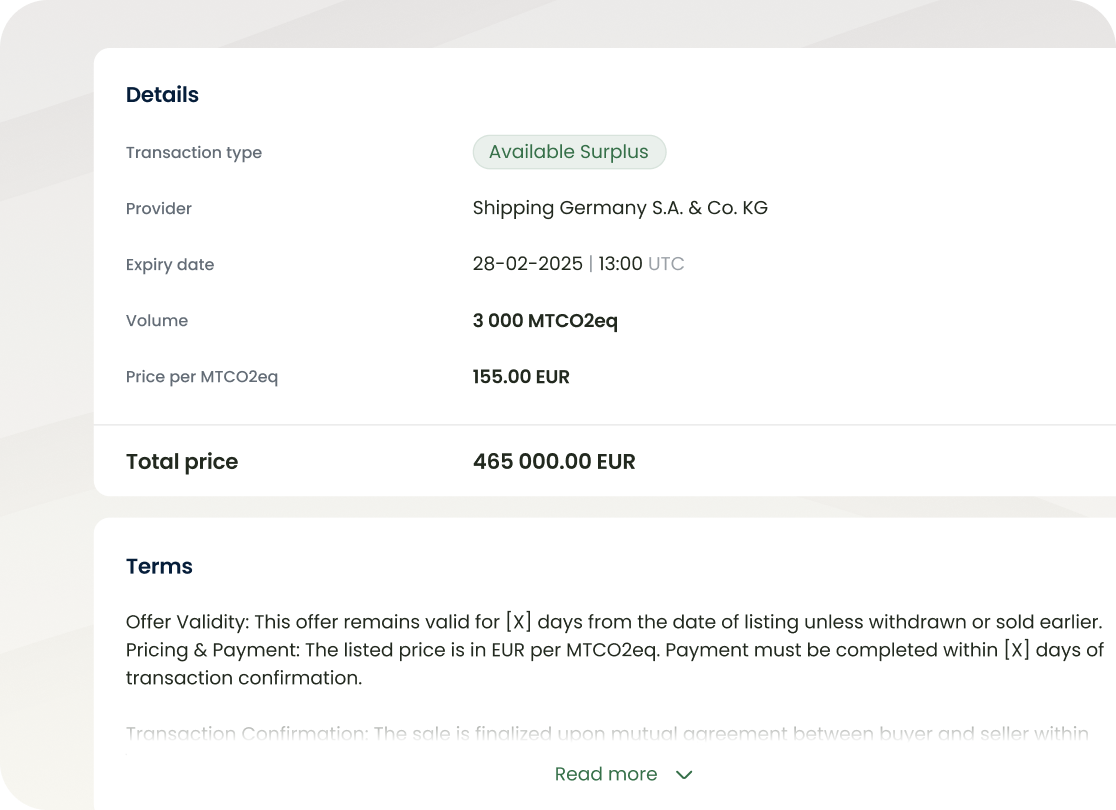

- Transparency & confidence – Clear view of prices, terms, and counterparties.

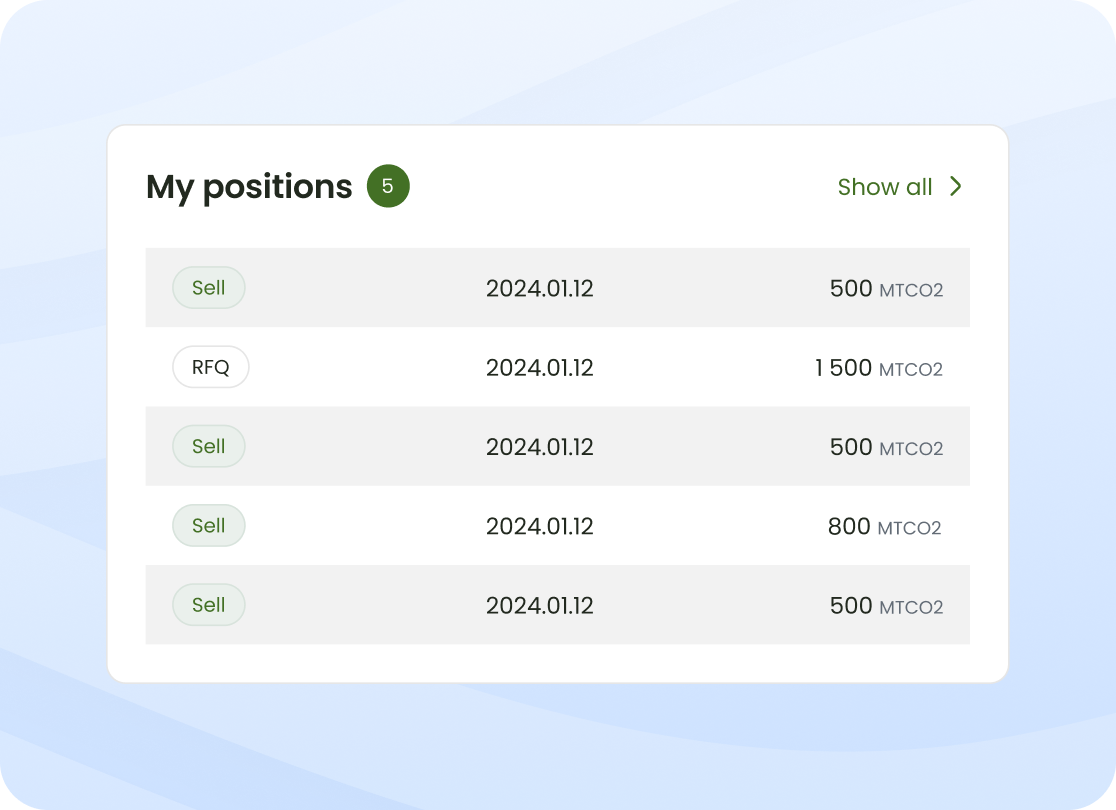

- Flexibility – Bank, sell, or top up during the April compliance window.

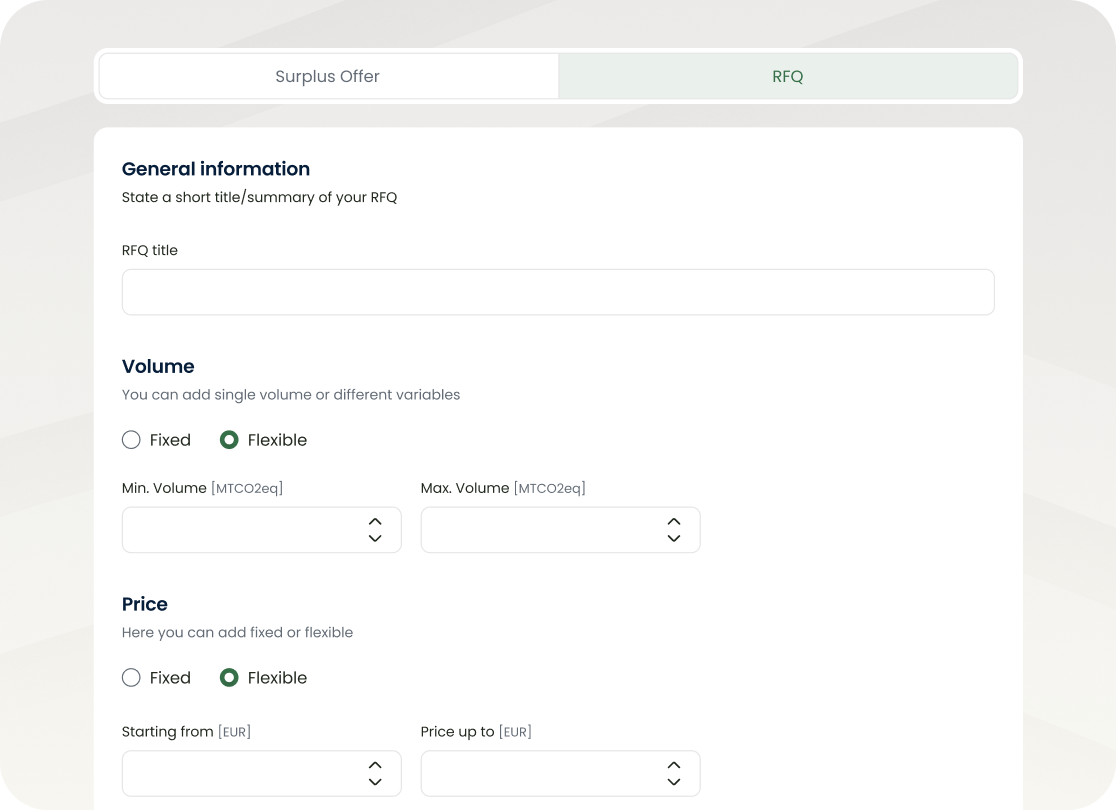

How the Pooling Marketplace Works

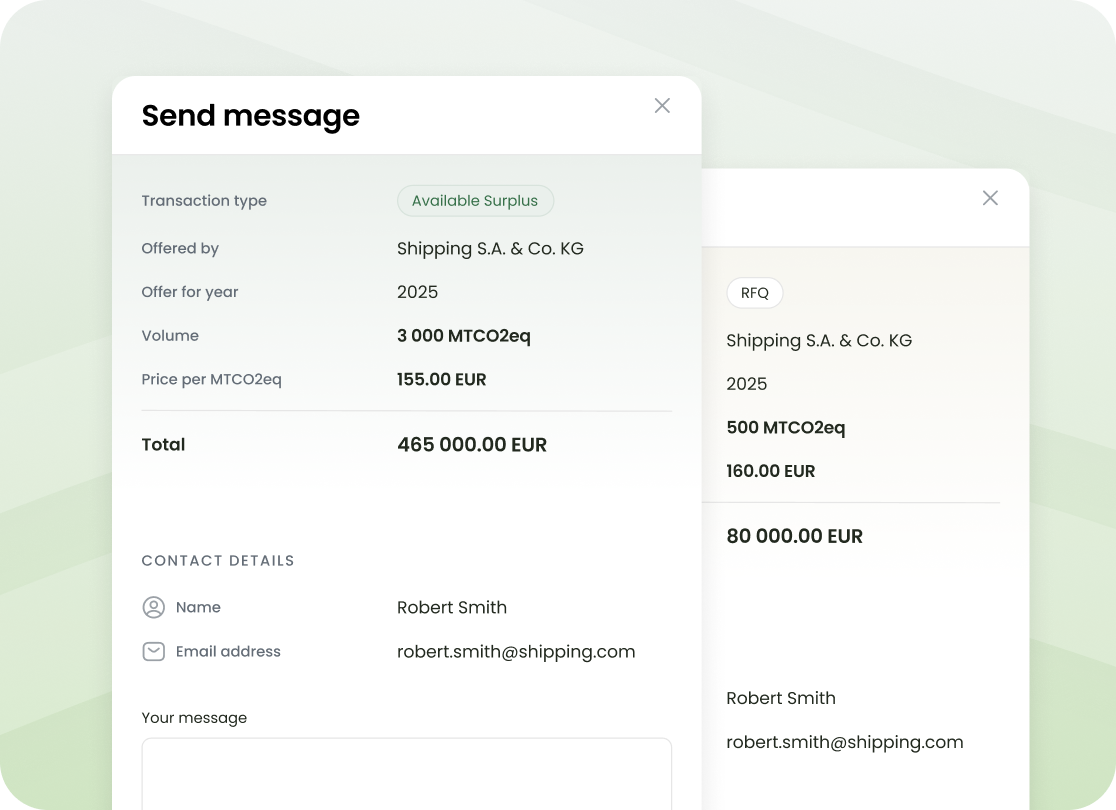

- Browse verified surplus offers from multiple providers.

- Compare partners, prices and terms with full transparency.

- Connect directly with buyers or sellers – no intermediaries, no hidden cuts.

Result: Efficient and transparent compliance.

What Sets Us Apart

- No transaction commissions; just a small onboarding fee.

- No exclusivity. Free to shop around and combine strategies.

- Backed by leading global players like MSC, Anglo-Eastern, V-Ships, IINO Lines, Nordic Shipping, and Döhle Group.

Plan Ahead With Confidence

Pooling is not just about avoiding penalties; it’s about building compliance strategies that fit your fleet:

- Lock in prices early, avoid last-minute market spikes.

- Bank surpluses for future years or sell excess in April.

- Combine pooling with other options like biofuels or penalties.

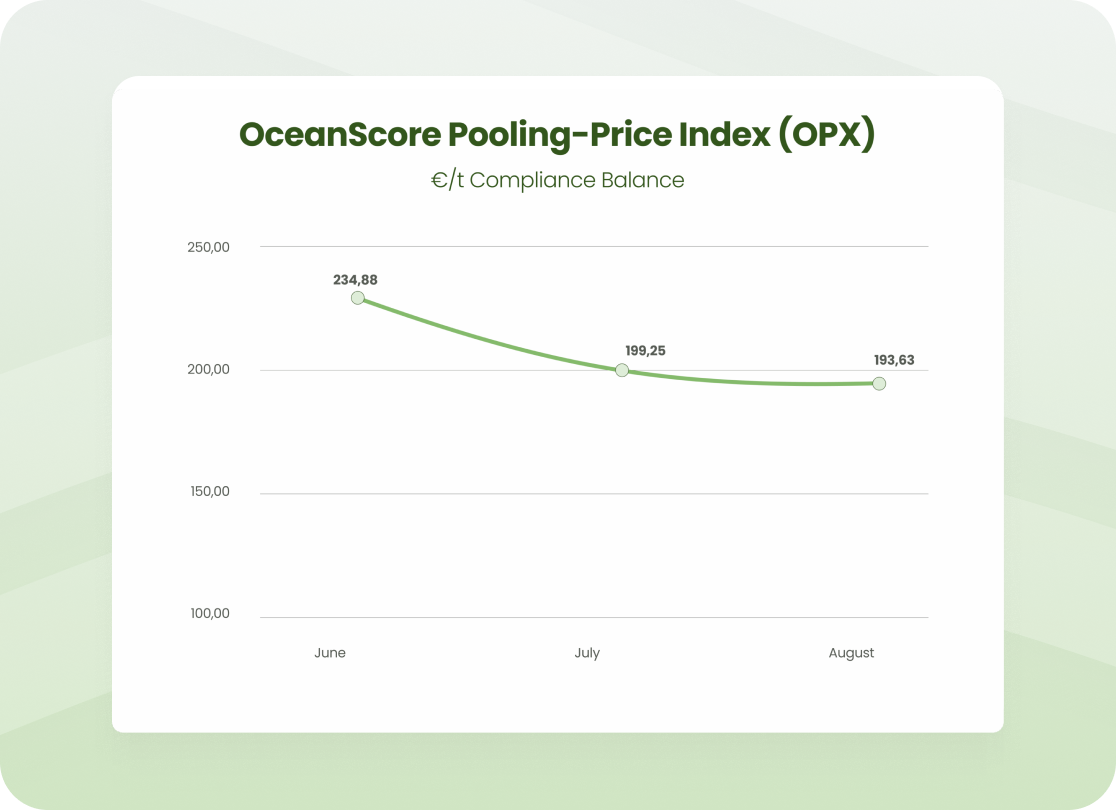

- Use transparent prices and OPX to inform charter-party negotiations.

Turn Compliance Into Competitive Advantage

Pooling helps to avoid penalties, reduce costs, and provide transparency. With OceanScore, you can manage compliance confidently and flexibly.

Leave your Emissions Compliance Management to us

We Collaborate with Your Partners as well

We work with relevant reporting solutions and verifiers to make sure all your data flows seamlessly, safely and with assured quality.