Some charterers are increasingly offering to pool compliance balances as a way to manage emissions obligations more efficiently. While this can support the “polluter pays” principle and may offer practical benefits in certain situations, it’s worth taking a closer look at the details to understand the potential implications.

Your Charterer Offers to Pool: What to Look Out For

Pooling can appear straightforward, but the actual arrangements can vary. For instance, certain periods—such as off-hire time—might be excluded from coverage. In some cases, charterers may still expect the owner to bear the emissions costs for these uncovered periods, occasionally at rates that exceed typical compliance costs.

Rather than being a warning sign in itself, this highlights the importance of clarity and careful planning. It might be helpful to assess what those emissions would cost outside the pooling structure and use that as a reference point when discussing terms. That way, both sides can work toward an arrangement that feels proportionate and fair.

Manage the Year-End Compliance Gap

When a vessel changes hands mid-year, only one charterer typically includes it in their compliance pool for that calendar year. This can lead to a bit of uncertainty, especially around transitions, and may affect how compliance obligations are shared.

One approach some have considered is incorporating flexibility into charter party terms—for example, by allowing cash compensation instead of pooling participation during certain transition periods. These conversations aren’t always simple, but addressing them early on can reduce friction and support more predictable outcomes for everyone involved.

Anticipate Future Changes in Pooling and Compliance Rules

Even the most carefully crafted pooling arrangements may need to evolve. Regulatory frameworks—both global and regional, like the IMO guidelines and EU ETS—continue to shift, and operational realities, such as vessel transfers or changes in chartering partners, can introduce new dynamics. What works well today might need rethinking tomorrow.

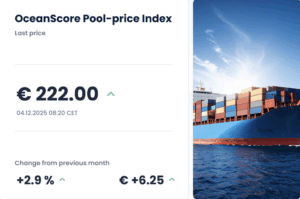

With that in mind, it can be helpful to maintain a forward-looking perspective. Keeping an eye on developments like FuelEU Maritime, while also understanding the underlying cost structures, may support more resilient decision-making. If your current ETS-related systems already allow for some degree of flexibility, those might serve as a useful starting point as requirements grow more complex.

Final Thoughts: Flexibility and Preparation are Key

Pooling compliance balances can offer practical advantages and promote shared responsibility, especially when terms are clearly understood and aligned. At the same time, these arrangements often benefit from a degree of flexibility and a willingness to revisit assumptions as regulations evolve.

There’s no one-size-fits-all solution, but being prepared to adapt through thoughtful contract structures and an eye on the regulatory horizon can help reduce friction and support smoother transitions in the long run.