FuelEU, a new maritime regulation, is not just a cost to shipping (in contrast to EU ETS, for example), it does actually inject money into our industry. To explain this counterintuitive perspective, let’s take a look at the numbers.

Understanding the Compliance Gap

As an earlier OceanScore analysis has shown, the sum of all compliance deficits of all vessels trading with a GHG intensity above threshold according to FuelEU is about 2.1mMT of CO2e. Vessels generating a surplus (mainly LNG and LPG carriers) generate a surplus of around 1.3mMT of CO2e.

For the market to be in balance, a net deficit of around 0.8mMT of CO2e thus needs to be closed and let’s assume that this will happen through the use of biofuels. Without going into too much detail, this use of bio fuel will require a somewhat higher volume of bunkers to be procured due to the lower LCVs of these fuels, will come at a higher cost and generate in return quite substantial savings with regards to EU ETS.

The Compliance Costs

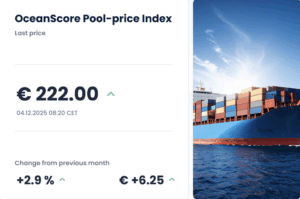

At current prices, exchange rates, EU ETS phase in of 70%, etc 1MT of CO2e compliance balance can be generated by burning bio fuels (UCOME) for net around €230.

Given that a net deficit of around 0.8MT CO2e needs to be closed and a cost of €230 / MT of CO2e, this will cost the industry just below €200m (a number many will find surprisingly low). And as LNG and LPG carriers we considered in this analysis run on LNG / LPG anyways, their share of the surplus is generated without additional cost.

Where Does the Extra Revenue Come From?

As significant share of the total emissions – around 28% – stems from container vessels, further 20% from ferries and cruise vessels, segments where emissions pricing appears the most straight forward. We analysed COAs and FuelEU surcharges (assumed FuelEU shares of emissions surcharges). A significant share of these includes emission charges, often – but not always – at the level of penalties.

Penalties are based on MT VLSFOe above the threshold of FuelEU – but if we convert this unit for the sake of this analysis into MT of CO2e, the penalty per MT of CO2e would be around €640. If only 50% of all vessel operators levy additional emissions charges (or costs in their COAs) to the eventual customer (cargo owner or passenger) and charge 2/3 of the penalty level, the total revenue increase will be in the range of €450m.

The industry net gain would be in the range of €250m. If this is sustainable remains to be seen, competition tends to wipe out windfall profits over time.

Who Will Capture the Windfall?

As the effects of this maritime regulation ripple through shipping’s value chain, the bigger question is where this net gain will end up in shipping’s value chain. With the charterer, the owner or the manager? This depends on the segment, the type of charter, the relative market power and the strategic preparedness of the different stakeholders involved.

Charterers will try to pass on more to their customers than they have to reimburse the owners for and managers will need to try to keep their cost of compliance (as they are the eventually responsible parties in FuelEU) below what they can charge to the owners.

The Case for Ship Managers

Ship managers, especially if they are 3rd party managers with typically thin margins are the most challenged. They need to be compensated for the risk they bear, for the additional effort to run the respective process and for cost of the tools to do so. Including the necessary upgrade to the reporting and verification solutions required, the cost will quickly be €3-4.000 per vessel and year (and more for smaller players).

We would like to make the case for the majority of the FuelEU windfall margin to be captured by a vessel’s manager. Given that there is windfall to be shared, they need not be shy in asking for their fair share.

Whether you’re a shipowner, charterer, or manager, now is the time to prepare for the opportunities FuelEU brings. Reach out to OceanScore to assess your compliance strategy, optimize your emission surcharges, and secure your fair share of the windfall.