FuelEU Pooling Marketplace: Trade Surplus, Avoid Penalties, Stay Compliant

Early, transparent access to surplus offers, with no transaction fees and full flexibility to support your compliance strategy.

FuelEU Pooling Explained

The Timeline

- Reporting period closes: 31 December 2025

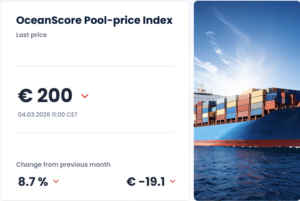

- Verified balances published: March 2026

- Official pooling window: 1–30 April 2026

The Opportunity

- Secure partners early and lock in today’s prices

- Bank surplus for future years

- Resell excess or top up deficits in April

- Avoid technical risks and sourcing challenges of biofuels

- Gain compliance options even if you don’t control fuel choice

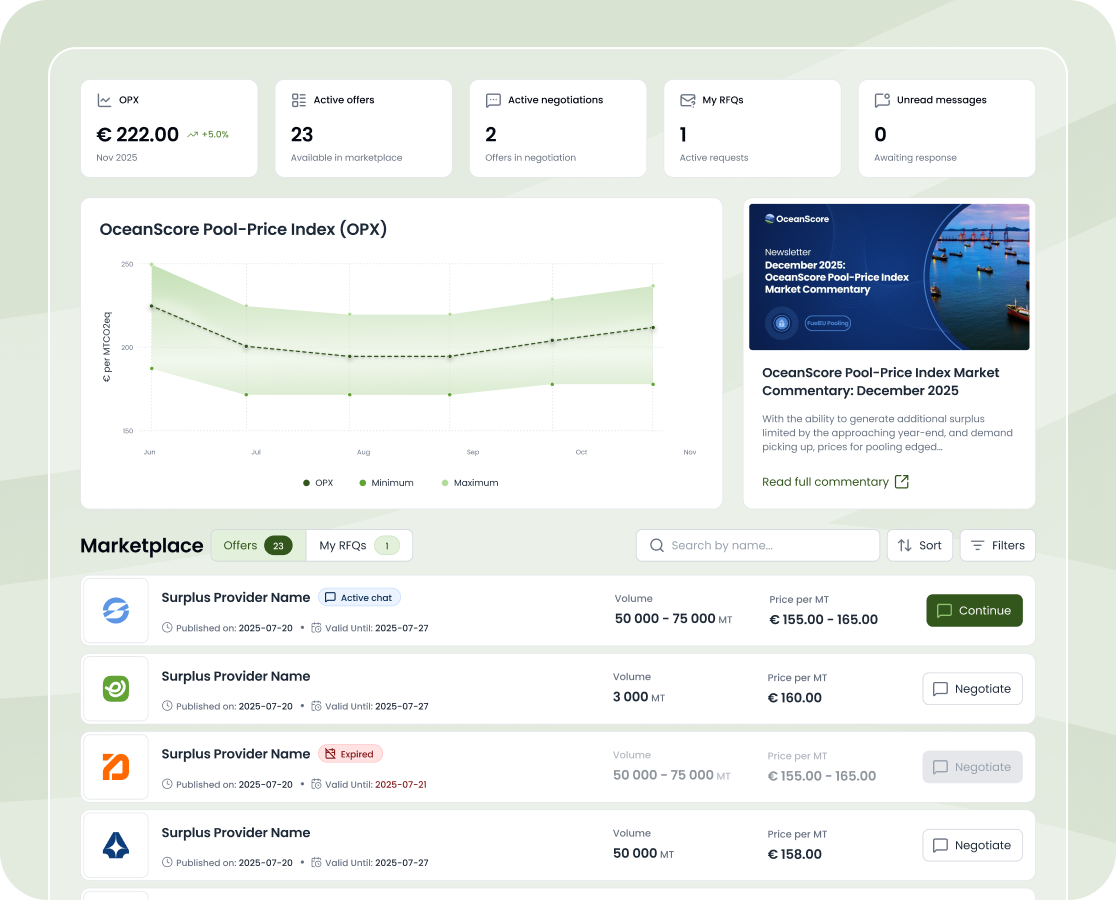

OceanScore’s Pooling Marketplace offers a smart, flexible way to not only stay compliant, but gain a competitive edge.

Simplify Compliance With The OceanScore FuelEU Pooling Marketplace

Market Access, Made Easy

- Lowest cost of compliance – Pooling today costs less than one-third of the FuelEU penalty.

- Simplicity – No sourcing headaches, no change-over risks, no operational disruption.

- Transparency & confidence – Clear view of prices, terms, and counterparties.

- Flexibility – Bank, sell, or top up during the April compliance window.

The FuelEU Pooling Marketplace is for

Whether you're a manager, owner or biofuel trader, buy and sell your compliance surplus with transparency and efficiency.

Managers / DOC Holders

who have surplus or deficit

Owners / Operators

to track prices and use them to optimize compliance strategies

Biofuel Traders & Suppliers

Who often have access to low-emission fuels in excess of their own usage

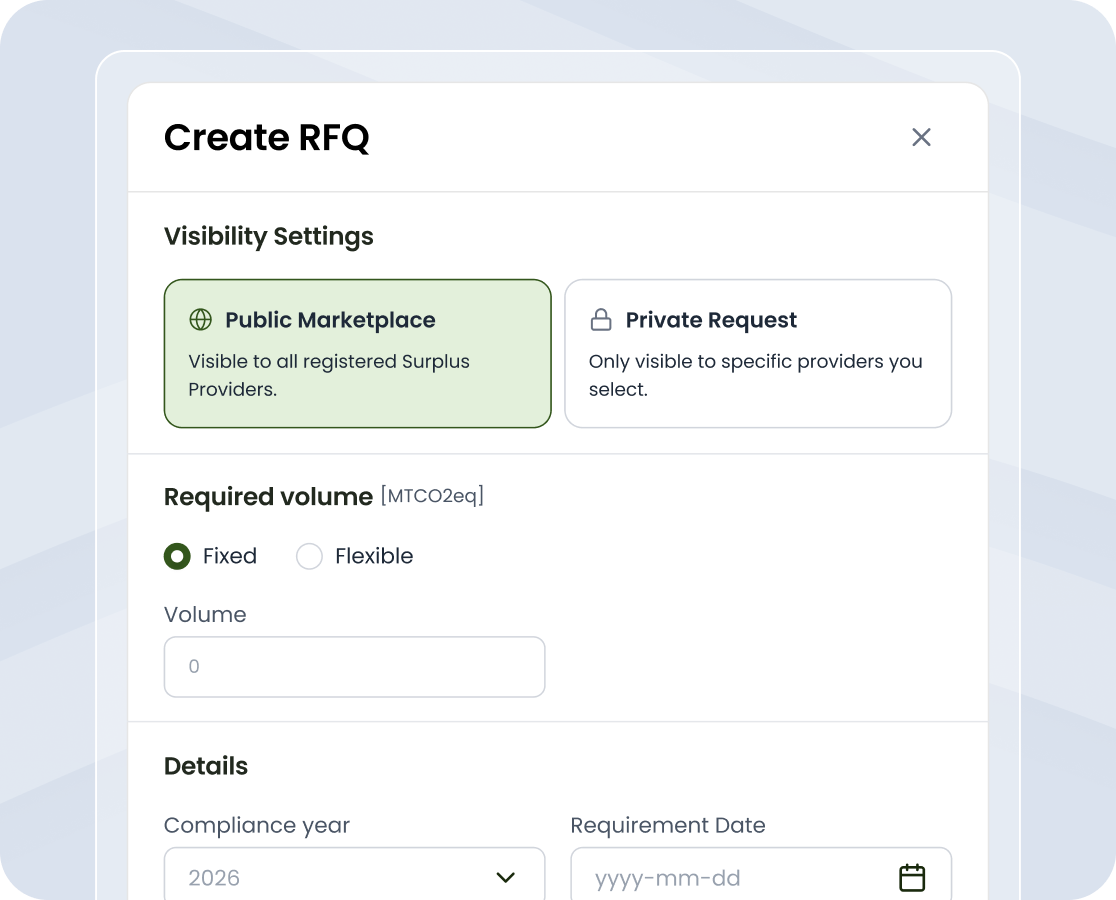

How the Pooling Marketplace Works

Whether you’re managing a fleet or operating under charter, the FuelEU Pooling Marketplace helps you comply with FuelEU Maritime in a cost-effective, flexible, and practical way.

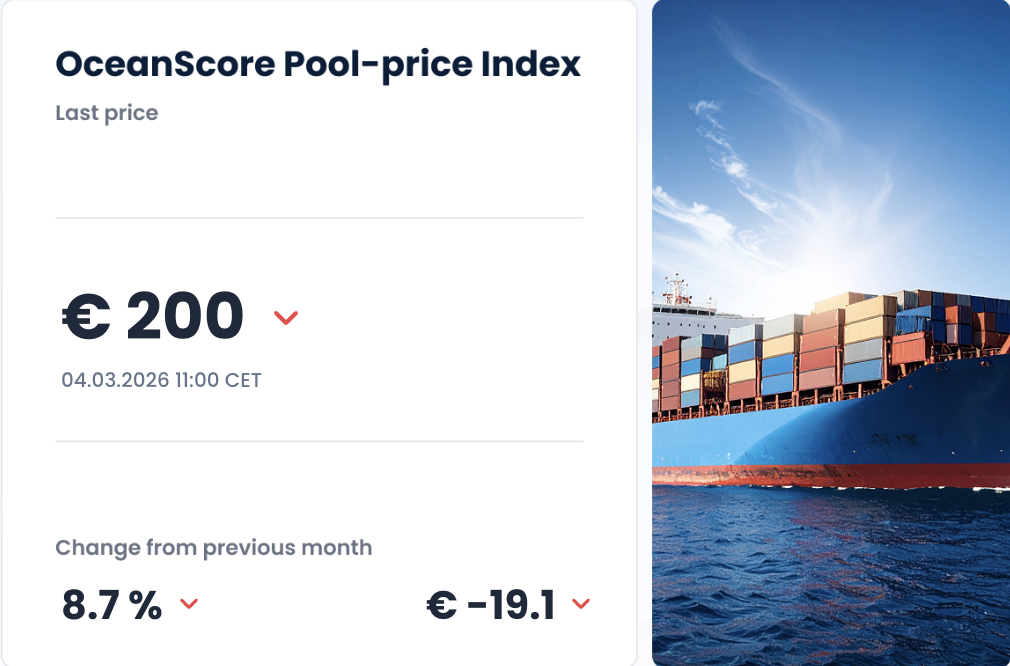

Browse surplus offers from multiple providers

Compare partners, prices and terms

Connect directly with buyers or sellers

Why Shipping Companies Trust OceanScore’s FuelEU Pooling Marketplace

Unlike traditional brokers or ad-hoc deals, we offer:

- No transaction commissions; just a small onboarding fee.

- No exclusivity. Free to shop around and combine strategies.

- Backed by leading global players like MSC, Anglo-Eastern, V-Ships, IINO Lines, Nordic Shipping, and Döhle Group.

FAQs

Our FAQs explain how FuelEU pooling works, when it happens, and how OceanScore’s marketplace helps make the process transparent, cost-efficient, and simple.

Avoid Penalties. Comply Strategically. Start Pooling Today

Turn FuelEU compliance into advantage. Join the FuelEU Pooling Marketplace to buy or sell surplus and lock in fair pricing - with no transaction fees.

Learn More About FuelEU Maritime and Pooling

Stay informed on FuelEU Maritime compliance, pooling strategies,

and costsaving opportunities. Explore insights from OceanScore:

FuelEU Pooling in 2026: From Commercial Agreement to Verified Compliance Process

FuelEU pooling in 2026 is no longer just a commercial agreement. Surplus transfers must be formally reported, approved by all…

FuelEU Maritime Charterer Pooling: Will Your Charterer Pool?

As the first FuelEU Maritime compliance year comes to a close, the reality of pooling is taking shape. Based on…

FuelEU Maritime Compliance: Why Pooling Is Infinitely Better Than Paying the Penalty

As global trade grows and decarbonization pressures increase, the shipping industry is facing heightened scrutiny over its environmental impact. At…