Singapore-registered vessels will be required to contribute a significant €330m share of Asian shipping’s total emissions liabilities under the EU ETS, underlining the importance of the Lion City as a key maritime hub for both global trade and decarbonization, according to OceanScore.

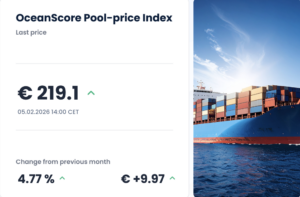

The Hamburg-based maritime technology firm’s modelling analysis shows that 5.5 million EU Allowances (EUAs), or carbon credits, will have to be surrendered for some 1120 liable vessels registered in Singapore once the EU Emissions Trading System (EU ETS) is fully implemented in 2026.

The cost calculation, which is based on the current carbon price of €60 per tonne of CO2, accounts for around a third of €1 billion in total emissions liabilities for Asia-based players previously estimated by OceanScore.

The volume of EUAs required of Singaporean players amounts to roughly 7% of nearly 80 million EUAs to be surrendered by shipping globally, with the share of EUAs for companies domiciled in the island nation expected to rise by about 3% annually, based on historic data modelling.

Strategic maritime position

This means Singapore is second only to China and Hong Kong, together with Taiwan, in having the highest number of EUA commitments among non-European countries and is also ahead of non-EU European nations like the UK and Norway, which will have to surrender 4.4% and 3.8% of global EUAs, respectively.

“These figures clearly demonstrate the importance and continued growth of Singapore aasuas a magnet for international shipping due to the advantages of its geographical location, as well as world-class port infrastructure, a diverse maritime services cluster, business incentives and green shipping initiatives,” says OceanScore’s co-Managing Director Albrecht Grell.

Singapore is situated along the Strait of Malacca, a heavily trafficked waterway that connects the Indian and Pacific oceans for ships sailing between East Asia and Europe. This strategic position reduces voyage distances, fuel consumption and transit times for ships, contributing to making Singapore – the world’s largest bunkering port – an economically attractive location for maritime activities.

The port is one of the world’s busiest shipping hubs, with annual tonnage arrivals increasing 9.4% to a record 3.09bn gross tonnes last year, reflecting growth across all ship segments despite a global trade slowdown, while container throughput grew by 4.6% to a new high of 39.01m TEUs in 2023, according to the Maritime and Port Authority of Singapore (MPA).

Heavyweights bear biggest burden

Mirroring this growth in traffic, the Singapore Registry of Ships surpassed the 100 million gross-tonnage milestone for the first time earlier this year, with a total of around 4000 vessels now registered, while Singapore hosts over 180 international shipping groups, the MPA states.

Grell says that 20% of Singapore’s EUA contribution will be paid for by four major container lines that have set up management units in Singapore – CMA CGM, K Line, MOL and NYK, with CMA CGM alone accounting for more than 10% of all Singapore’s EUAs.

“The fact that another 25% of EUAs can be attributed to just six of the largest foreign-owned third-party ship managers active in Singapore underlines its attractiveness as a global shipping hub,” he adds. Among ship management companies active in Singapore are Anglo Eastern, OSM Thome, Fleetmanagement, Columbia Ship Management, Bernhard Schulte and others.

The number of liable Singapore-registered vessels represents around 9% of the total 12,500 cargo and passenger ships above 5000gt that are currently subject to the EU ETS.

The EUA cost burden per Singaporean vessel is though below that of the average vessel in European trade due to both fleet mix differentiation – with EU-registered cruise and ropax vessels having higher emissions intensity – and the fact voyages to/from Europe are liable for 50% of emissions, versus 100% for those between European ports that are undertaken more frequently by EU-domiciled shipping companies, according to OceanScore.

EUA costs can ‘boost green investments’

Excluding cruise and ropax, the proportion of Singapore’s EUA liabilities is similar to that of Europe for the main ship segments, with container vessels accounting for 29% of its EUAs and tanker and bulk shipping 19% each.

But Grell points out an “interesting anomaly” is that 11% of all EUAs to be contributed by Singaporean shipping are caused by emissions during port calls in Europe, versus an average of 6% for EU-registered vessels, across all ship types and segments. “Given the price of emissions will only increase, this is worth exploring,” he says.

OceanScore is now supporting a growing number of non-European shipping companies with EU ETS compliance through its web-based digital application ETS Manager, an end-to-end management solution for tracking, allocation and accounting of EUAs to simplify complexity and mitigate risk.

The firm, which is set to open a representative office in Singapore shortly, currently serves more than 70 shipping companies worldwide, representing over 1000 vessels.

The Singaporean authorities, including the MPA, are taking a leading role in decarbonization of shipping through initiatives such as bunkering standards and infrastructure to promote alternative fuels and a local carbon tax. And Grell believes EUA costs exposure will further incentivize investments by locally registered shipping companies in carbon-reduction technologies to cut emissions, in line with the purpose of the EU ETS.

“With its many leading shipping companies, relevant initiatives and an innovative maritime cluster, Singapore is taking a forward-leaning approach to promote green operations and is well-prepared to succeed in an environment where emissions are increasingly impacting the bottom line,” he says.