Acquisition of EUAs constitutes a major cost burden for the responsible party so these costs need to be fairly allocated between the respective stakeholders – shipowner, manager, operator, cargo owner and charterer – to ensure economic accountability across the value chain.

The ‘polluter pays’ principle ultimately dictates the charterer, which is typically responsible for purchasing fuel under many charter contracts, also should cover emission costs but this has yet to be stipulated by the EU. The burden of purchasing EUAs therefore remains on the owner, or technical manager, as DoC holder.

This requires having clearly defined contractual structures in place and accurate, verified data to provide a single source of truth for all parties that can minimize the risk of pricing disputes.

While EUAs only have to be surrendered in September of the year following the reporting year, these need to be acquired on an ongoing basis in line with real-time emissions, thus racking up liabilities for the DoC holder from day one of EU ETS implementation.

The EU ETS will therefore trigger multiple commercial transactions among stakeholders to cover their respective share of emissions costs in relation to voyage charters and these will need to be settled on an ongoing basis using accurate data to meet financial obligations to buy EUAs.

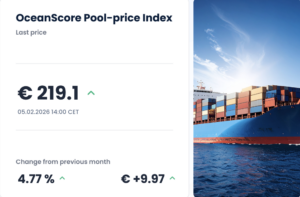

Purchasing EUAs can be a significant expense for shipping companies that has an impact on economic factors such as operating costs and balance sheet risk. This is likely to have implications for pricing and other terms of contractual agreements among different stakeholders, including charterers and cargo owners.

Consequently, charter parties must include EU ETS clauses that provide a contractual framework for settlement of EUA costs, as well as define how to request EUAs.

A solid template is Bimco’s proposed contract clause with standard terms for settlement of transactions related to the cost of allowances that is intended to shield the shipowner from emissions liabilities incurred by the charterer. Basically, it states the owner and charterer will share all relevant data in a timely manner throughout the year to calculate the number of EUAs to be surrendered to the authorities for the period of the vessel charter party.

Bimco has also prepared useful clauses in relation to the EU ETS that include definitions, responsibilities, time periods for the transfer of EUAs and remedies for failure to perform.

While incorporating advantageous clauses depends on market dynamics, it is crucial to consider counterparty risk. Prepayments and collaterals become vital, especially when charterers lack a proven track record of trust and creditworthiness. Emphasizing the importance of regular settlements in mitigating counterparty risk is evident.

In dealing with charter party EU ETS clauses, a crucial aspect is how to request EUAs. We strongly suggest avoiding settlements in funds; instead, requests and provisions should be made in EUAs, and the corresponding EUAs should be provided.

Opting for cash-based settlements poses challenges in determining the right price and may require more complex structures. Due to the intraday volatility of EUA prices, which can often fluctuate by around 5 Euros, even a real-time money transfer based on a specific quote can be too late. In addition, given the different perspectives of charterers, owners, and managers, quotes from their respective traders can differ significantly.