Following the close of the first FuelEU Maritime compliance year, the pooling market is entering a more differentiated phase with clear signals now emerging for both 2025 and 2026 compliance surplus.

2025 Surplus: From January Dip to February Rebound

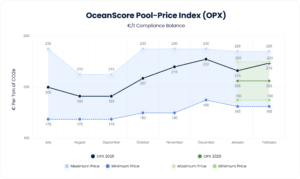

After compliance balances were closed at year-end, additional 2025 surplus volumes were released to the market in January. This increase in available supply led to a temporary easing of pooling prices, with OPX dropping to €213 per ton of CO₂e.

By February, this surplus had largely been absorbed. As demand increased again, prices rebounded sharply.

The OceanScore Pool-Price Index (OPX) for 2025 surplus has now climbed back close to last year’s peak and stands at €219 per ton of CO₂e.

With the April pooling deadline approaching, further upward pressure on prices should be expected as companies move to finalise compliance positions.

First Price Signals for 2026 Surplus

OceanScore has now started reporting prices for 2026 compliance surplus, providing an early reference for companies planning ahead.

As anticipated, 2026 prices are currently below 2025 levels. With eleven months remaining to generate surplus and EU ETS now fully phased in at 100%, the market reflects greater flexibility and optionality.

The OPX for 2026 surplus currently stands at €205 per ton of CO₂e.

While lower than 2025, these levels underline that FuelEU compliance remains a material commercial cost, and that early visibility matters.

What This Means for Compliance Decisions

The recent price movements reinforce two key points:

-

Timing matters. Waiting for full certainty on exposure can mean missing more favourable pricing windows.

-

Markets are differentiating. 2025 and 2026 surplus are already pricing differently, reflecting regulatory phase-in, time to act, and demand dynamics.

As FuelEU moves further into execution, pooling decisions are no longer administrative steps. They are commercial decisions with direct cost impact.

OceanScore will continue to monitor pooling activity and publish OPX updates on a regular basis to support transparent, data-based decision-making.

Click here to learn more about OceanScore’s FuelEU Pooling Marketplace.