An integrated solution that enables ship operators both to manage emissions liabilities and trade carbon allowances under the impending EU ETS regime for shipping has been launched by maritime data firm OceanScore as a comprehensive EU ETS management solution for the shipping industry.

“The industry faces a major challenge to navigate the complexity of the new regulation and mitigate financial risk due to the requirement to purchase carbon credits to cover the cost of emissions, which will reach €8 billion or more annually,” OceanScore’s co-Managing Director Albrecht Grell said.

“The interplay between owners, managers and charterers creates significant complexities unique to shipping and poses potentially significant risks, especially for ship managers, if not managed properly. Excel alone will not be sufficient to maintain transparency and control of these processes.”

The Hamburg-based firm has therefore developed the web-based ETS Manager to manage and monitor the entire process from automatically ingesting vessel operational data, assessing the need for EU Allowances (EUAs), allocating them to owners or stakeholders, requesting and accounting for them, and tracking open positions. It incorporates the advanced trading tool EUA Trader, powered by RWE Supply & Trading, to buy and sell EUAs.

OceanScore’s EUA Trader is also available as a standalone application. Furthermore, for those clients who wish to outsource management of their EUA accounts to their respective registries, OceanScore can support this by monitoring account movements through various APIs in ETS Manager.

Automating the Process of Compliance

Grell said the comprehensive solution, with a high level of automation to reduce administrative workload and possible issues with wrong data entries, is geared to “simplifying complexity” for shipping companies.

ETS Manager is rapidly gaining traction among both European and non-European customers ahead of the phased implementation of the EU Emissions Trading System (EU ETS) for the maritime sector from 1 January 2024, with OceanScore investor Döhle Group among several pilot customers, he added.

Shipping companies, as the designated Document of Compliance holder (DoC holder) under the EU ETS regime, will be required to surrender to the authorities EUAs based on their annual emissions, starting at 40% of emissions in 2024 and rising to 70% and 100% of emissions in 2025 and 2026, respectively, under the three-year phase-in of the scheme.

This will necessitate having administrative systems in place to track emissions and determine the volume of EUAs required, as well as to assign the costs of these to the owner or charterer based on the ‘polluter pays’ principle to avoid unnecessary financial exposure for the DoC holder, typically a ship manager.

Monitoring EUA Liabilities

OceanScore’s co-Managing Director Ralf Garrn explained the regulation poses issues such as how to accurately monitor emissions, how to acquire and trade EUAs, which trading platform to use, how to achieve the best price, how many EUAs should be purchased and who should pay for carbon credits.

“With the clock ticking to implementation of the EU ETS, shipping companies need to understand the practical implications and initiate efficient systems to address these issues and ensure compliance. A solid monitoring solution, properly covering the many different options to deal with the ETS regime, is a necessity given the complexities of shipping and the ETS regulation,” he said.

Garrn explained that ETS Manager is undergirded by a network of third-party collaborations to support a smooth end-to-end process for emissions management, from securing good-quality data at the outset to ensuring trustworthy EUA trading at the other end.

By collaborating with verifiers and data quality service providers like DNV’s Emissions Connect, Seacotec, Swiss Climate and Verifavia, OceanScores ensures for joint customers that data in the ETS Manager corresponds to the final, verified annual data that are the basis for surrendering EUAs to the respective authorities, as well as allowing for a seamless, API-based data flow.

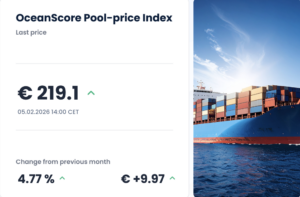

Reliable Trading Platform

EUA Trader tracks the market price of EUAs and facilitates buying and selling of carbon credits on the RWE Supply & Trading platform through a simple, all online operation, with the ability to buy incremental volumes as needed and forward trading flexibility to hedge the risk of price changes.

EUA purchases can be made for individual or multiple ships and these transactions can be allocated to specific stakeholders in the value chain, thereby eliminating the need to conduct inter-company trades and avoiding unnecessary price/cost disputes.

Grell emphasised the importance of selecting a reliable trading platform with transparency on pricing to achieve the most economic EUA transactions and thereby minimise the cost of emissions.

“RWE Supply & Trading has a strong international reputation with high credibility and a proven track record in EUA trading, making them the ideal partner for our market-leading ETS solution for shipping,” he said.

“The feedback we are getting from the market is that the flexibility of the trading platform we offer, as well as the full integration of this trading platform into our ETS management solution, offer unique benefits to the shipping community. Our extremely competitive prices serve as an additional argument.”

For more information contact:

Albrecht Grell, co-Managing Director, OceanScore.

Email: albrecht.grell@oceanscore.com

About OceanScore

OceanScore is a Hamburg-based provider of sustainability data and compliance solutions with a strong maritime background. The company offers a range of ESG tools, including a robust EU ETS management solution tailored to maritime compliance needs.