With only a few weeks remaining in the year, new biofuel voyages can no longer be planned, bunkered, and completed in time to count towards 2025 FuelEU Maritime compliance.

That leaves two practical options:

-

Accept the penalty of €640 per ton of CO₂e, or

-

Buy the required surplus through a pooling agreement.

Pooling Prices Continue to Rise

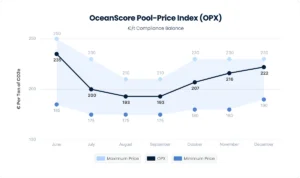

According to the OceanScore Pool-Price Index (OPX), December saw another increase:

OPX December: €222/ton CO₂e (up from €193 earlier this year)

For a vessel with an average deficit of 60 t CO₂e, the cost difference between pooling and penalty exceeds €25,000 per ship.

Prices are expected to rise further as the April 2026 pooling deadline approaches and demand accelerates.

What We See in the Market

-

Several surplus providers paused December offers due to tightening internal balances.

-

New providers entered the market, helping maintain liquidity but not stopping the upward trend.

-

More companies are shifting from banking surplus to selling it, responding to price signals.

Overall, liquidity remains healthy, but the trajectory points upward.

Why Many Still Haven’t Acted

The most common reason for delay remains uncertainty about the exact compliance balance for 2025.

This concern is understandable, but commercially costly.

Two points matter:

-

Price certainty outweighs exposure uncertainty. With prices continuing to rise, waiting carries more risk than acting.

-

There is no downside to buying early. Any 2025 surplus purchased now can be banked and used for future years.

Looking Ahead

We will continue to closely monitor pooling activity and OPX developments and provide further market updates.

If you wish to discuss the current offers, our team is available to support you.

Click here to learn more about OceanScore’s FuelEU Pooling Marketplace.