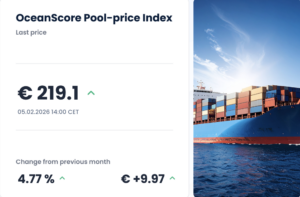

EUAs can be purchased at a fixed price at auctions arranged during the year by the European Energy Exchange. They can also be bought and sold on the secondary market through brokers or online trading platforms at a price that fluctuates with supply and demand, The variable price reflects the cost of reducing emissions.

When determining an EUA procurement strategy, key considerations are to assess the volume of allowances required based on expected emissions and to select a competent trading partner – whether it be a bank, shipbroker or carbon broker.

Simple buying strategies and streamlined trading structures represent the best way forward, with one or a maximum of two EUA trading partners. There is little to be gained from setting up multiple sources and trading agreements, or spending time on finding the lowest possible price, as prices will not differ much by source.

From the perspective of an owner or manager, the important aspects of such a strategy are:

- Flexibility to buy odd volumes – the exact numbers needed rather than bundles, as only a few EUAs may need to be purchased for periods of off-hire or unemployment.

- The ability to trade EUAs in case of excess.

- Purchase of spot and forwards through the same source to avoid complexity.

- Access to a digital, state-of-the-art trading interface

In general, we advise owners/managers against speculation with EUA purchasing, but rather that they focus on meeting their actual requirements for emissions incurred with off-hire or unemployment. The decision between buying forwards (not futures, in our view) or spot largely depends on liquidity needs and the company’s cost of capital.

However, the buying approach may become more intricate when vessels are fixed with payments from cargo owners to cover EUA costs. In such cases, owners would secure the needed EUAs as forwards at the contract-assumed price, aligning the execution date for the forward around when they are due to receive payment for the transport.

Similarly, there may be instances where charterers might not be able to provide EUAs but instead will provide funds for the owner/manager to buy EUAs.

In cases of parcelling where cargo shipments are divided or grouped into distinct units, such as in the tanker or heavy-lift business, we initially looked at allocating EUAs to different parcels. However, we now recommend the induced costs of transport in European waters are incorporated into commercial discussions and pricing decisions. This approach simplifies matters and gains acceptance from most customers. If specific customers want to contribute EUAs, this can be factored in separately.