With the first FuelEU Maritime compliance period completed, surplus providers now have full clarity on the exact compliance surplus they generated in 2025.

This increased certainty is now clearly visible in the market.

Increased Supply After Compliance Completion

As surplus positions became final, the volume offered on OceanScore’s FuelEU Pooling Marketplace increased significantly compared to late 2025. Additional surplus volumes entered the market as providers moved from internal assessment to active offering.

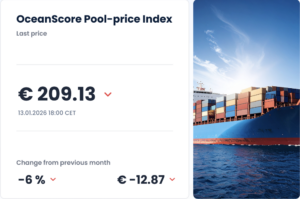

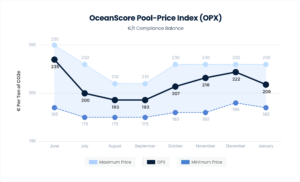

This shift in supply is reflected in the latest OceanScore Pool-Price Index (OPX).

OPX Moves Lower for the First Time in Months

According to OPX:

OPX January 2026: €209.13 / ton CO₂e

Change vs. December 2025: –6%

This marks the first downward movement in OPX after several months of rising prices toward year-end.

What This Means for the Market

The completion of the compliance year has reduced uncertainty on the supply side. With exact balances confirmed, surplus holders are now able to bring volumes to market with confidence.

At the same time, demand remains structurally supported by the approaching April pooling deadline. As a result, market activity is expected to remain active, with pricing influenced by the balance between newly offered surplus and remaining demand.

Looking Ahead

OceanScore will continue to monitor pooling activity and OPX developments closely and provide regular updates as the market evolves toward the April 2026 deadline.

For companies evaluating their FuelEU compliance strategy, current market conditions underline the importance of timely visibility into exposure, available surplus, and pricing.

Click here to learn more about OceanScore’s FuelEU Pooling Marketplace.