FuelEU Pool Prices Heading North

OceanScore’s Pool-Price Index (OPX) is climbing again this October — just as expected.

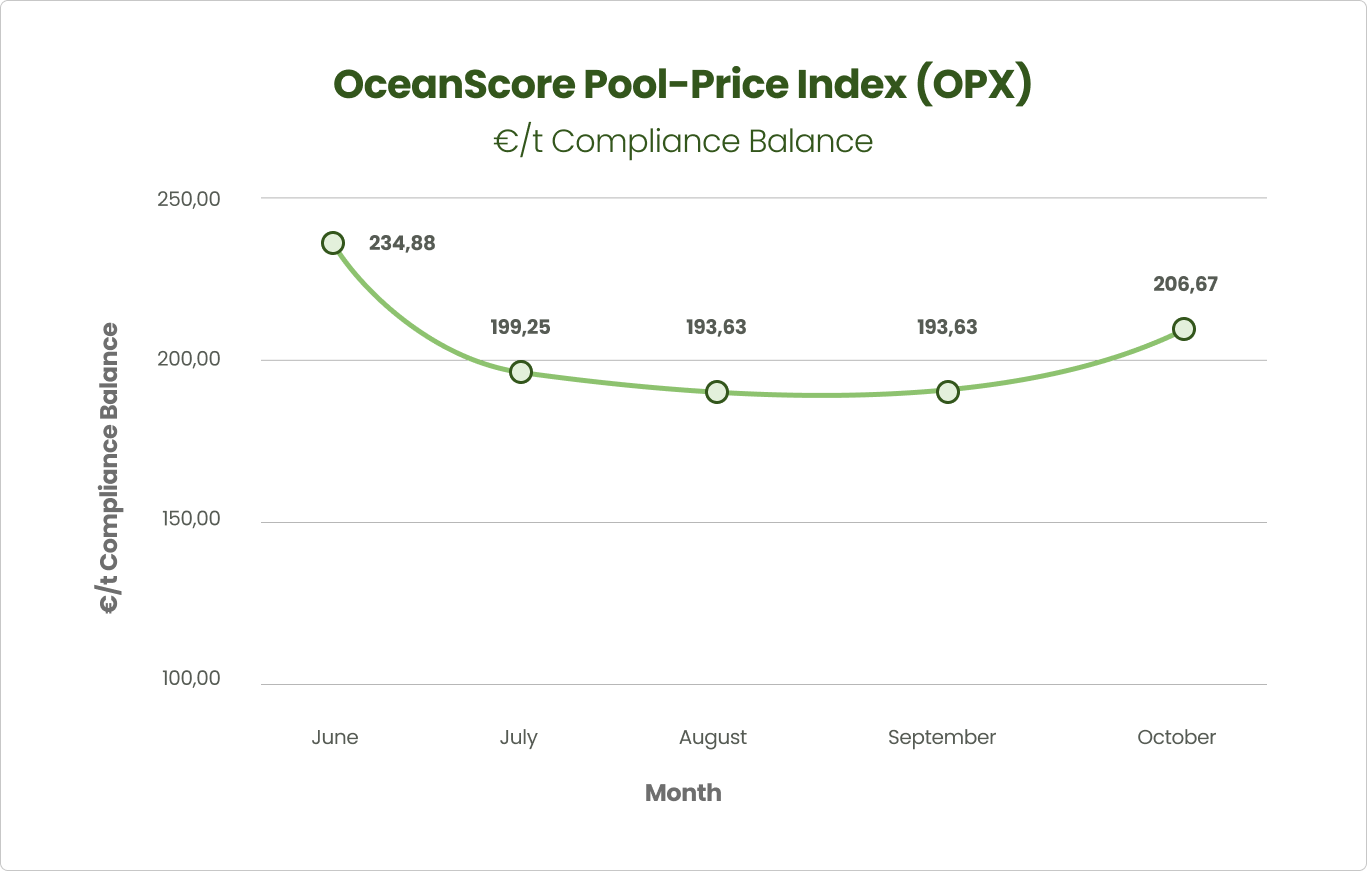

After a calm summer, the OPX reached its lowest point at €193 / ton of CO₂e in August and September. The index is now rebounding, with October figures showing a sharp increase to €207 / ton of CO₂e. So, what’s behind this movement?

Market Dynamics: Supply, Demand, and Timing

The FuelEU pooling market brings together a diverse group of participants — some offering surplus credits, others seeking to buy them. Each transaction depends on matching these two sides at a mutually attractive price.

During the summer, trading activity slowed, leading to a temporary dip in prices. But as the season ended and compliance planning resumed, transaction volumes picked up. This surge continued into October and is expected to grow further as we approach the year’s close.

Those seeking surplus credits naturally aim for the lowest possible price. However, since each supplier’s surplus is finite, the best deals are quickly absorbed, leaving behind offers at higher prices. These higher prices, in turn, attract new sellers into the market — leading the market equilibrium price to rise.

What This Means for You

The upward trend is likely to continue. If your company still needs to secure surplus for pooling, waiting may work against you. Prices are tightening as supply gets absorbed.

Our advice:

- Act early. Secure your pooling position sooner rather than later.

- Forecast proactively. Use a forecasting tool such as OceanScore’s Compliance Forecaster to estimate your surplus or deficit and include a margin for uncertainty.

- Stay flexible. If you end up with more than you need, it’s no problem — surpluses can be banked toward 2026 compliance or even resold later.

The Bottom Line

The post-summer upswing in OPX reflects a healthy, maturing market with increasing transparency and trading activity. For participants, the message is clear: time is not your friend.

Get ahead of the curve — and the price curve — while you can.

Click here to learn more about OceanScore’s FuelEU Pooling Marketplace.