OceanScore Pool-Price Index

The benchmark for FuelEU pooling prices: transparent, reliable, and based on real transactions.

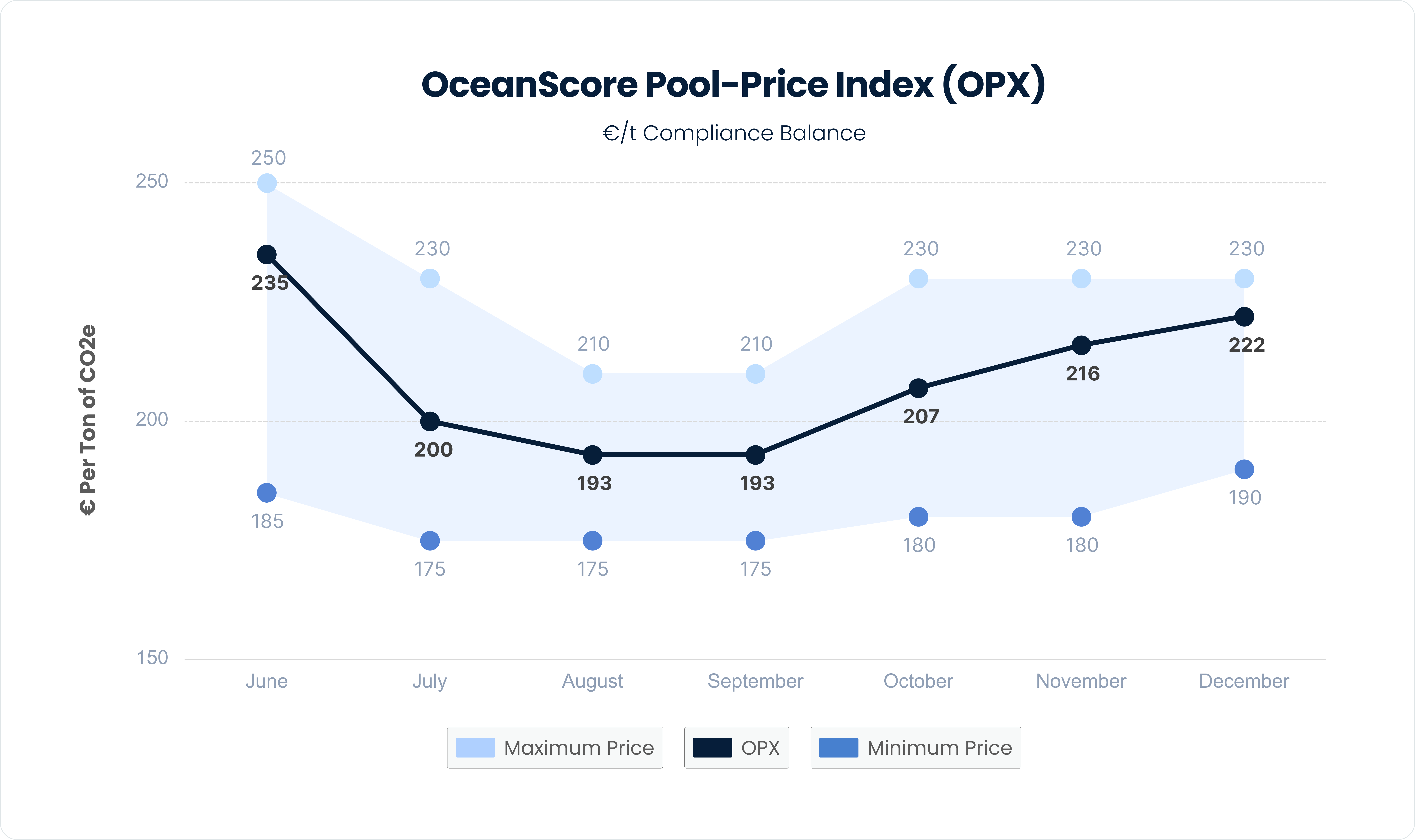

OPX reflects pooling prices across three volume baskets

OPX uses a volume-weighted methodology to reflect real trade dynamics, with full transparency so counterparties can trust it.

It is completely independent, free from fees or margins, and ensures accuracy by avoiding distortions from changing lot sizes.

Monthly OPX Commentary

- Insights

OceanScore Pool-Price Index Market Commentary: December 2025

With the ability to generate additional surplus limited by the approaching year-end, and demand picking up, prices for pooling edged…

OceanScore Pool-Price Index Market Commentary: November 2025

With the ability to generate additional surplus limited by the approaching year-end, and demand picking up, prices for pooling edged…

OceanScore Pool-Price Index Market Commentary: October 2025

As global trade grows and decarbonization pressures increase, the shipping industry is facing heightened scrutiny over its environmental impact. At…

Bringing Transparency to an Intransparent Market

Pubic & Transparent Published openly, with methodology fully explained.

Accuracy Reflects real deal sizes via weighted baskets.

Neutrality Not biased by us

selling surplus:

Nomargin included,

no hidden interest.

Utility benchmark for

charter-party

settlements, shipman

clauses, and biofuel

comparisons.

Insights on FuelEU Pooling

- Insights

FuelEU Maritime Charterer Pooling: Will Your Charterer Pool?

As the first FuelEU Maritime compliance year comes to a close, the reality of pooling is taking shape. Based on…

FuelEU Maritime Compliance: Why Pooling Is Infinitely Better Than Paying the Penalty

As global trade grows and decarbonization pressures increase, the shipping industry is facing heightened scrutiny over its environmental impact. At…

Navigating EU Maritime Regulations: A Different Challenge for Commercial Pools, Operators and Charterers

As global trade grows and decarbonization pressures increase, the shipping industry is facing heightened scrutiny over its environmental impact. At…

OceanScore: Your One-Stop Shop for Shipping Compliance Price Benchmarks

While FuelEU compliance costs depend on pooling prices, EU ETS compliance costs depend on EUA market prices. OceanScore brings them all in one place:

OPX – OceanScore Pool-Price Index

A transparent, basket-weighted benchmark for FuelEU pooling transactions, trusted for charter-party and SHIPMAN agreements.EUA Prices

Live market reference prices for EU Allowances, directly impacting EU ETS compliance costs. Integrated into OceanScore’s platform for trading, exposure tracking, and budgeting.

Together, OPX and EUA prices give you full transparency over regulatory compliance costs across both FuelEU Maritime and the EU ETS.

FAQs

Find answers to the most common questions about the OceanScore Pool-Price Index (OPX) and how it supports FuelEU pooling, charter-party negotiations, and compliance planning.

Avoid Penalties. Comply Strategically. Start Pooling Today

Turn FuelEU compliance into advantage. Join the FuelEU Pooling Marketplace to buy or sell surplus and lock in fair pricing - with no transaction fees.