The maritime industry’s relationship with EU environmental regulations has been complicated, to say the least. When the EU Emissions Trading System (ETS) launched, shipping companies found themselves facing an additional €6 billion burden once the system reaches full implementation by 2026, a figure that doesn’t even account for the planned expansion to vessels over 400GT scheduled for 2028.

Then came FuelEU Maritime compliance, bringing with it another wave of regulatory complexity and compliance costs. Beyond the technical challenges and the somewhat unclear implementation of the “polluter pays” principle, the industry once again focused on the additional financial burden this regulation would impose.

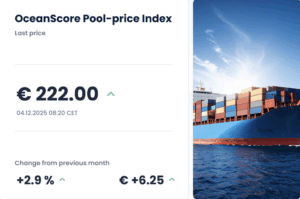

However, a new analysis by OceanScore reveals an unexpected twist: FuelEU Maritime compliance could actually generate a surprising €500 million annual profit opportunity for the shipping industry.

The Hidden Profit Potential in FuelEU Maritime Compliance

The key to this profit potential lies in the different compliance pathways available under FuelEU Maritime regulations. Companies that fail to comply face penalties of €2,400 per metric ton of Very Low Sulfur Fuel Oil (VLSFO). If the industry continues with current fuel blends, total penalties could reach approximately €1.4 billion.

But here’s where the opportunity emerges: alternative compliance options including alternative fuels, LNG, and biofuels cost roughly one-third of the penalty fees. Even better, some segments generate compliance surplus at virtually no extra cost, particularly LNG and LPG carriers that burn their boil-off gas anyway.

The profit mechanism works like this: if shipping companies can invoice customers for compliance costs at penalty levels while actually complying through cheaper alternatives (biofuels or pooling arrangements with surplus providers), approximately €1.1 billion would remain with the shipping industry.

Segment-Specific FuelEU Maritime Compliance Profit Potential

OceanScore’s analysis of publicly available data, marketplace transactions, and customer insights reveals significant variations across shipping segments.

Container shipping presents the highest profit potential. Liner companies routinely charge compliance surcharges and are most likely to pass costs to customers at penalty levels. This segment also generates the largest compliance deficit, accounting for 31% of all FuelEU shortfalls industry-wide.

Oil tankers, on the other hand, face more sophisticated customers who typically negotiate surcharges down to approximate the cost of cheaper compliance alternatives. While this reduces profit margins, tankers only represent 12% of the industry’s total deficit.

When aggregating across all segments, the analysis points to an estimated additional industry margin of €500 million, with potential to reach €750 million depending on contract negotiations and chosen compliance strategies.

The Reality Check: Implementation Costs

It’s important to acknowledge that realizing these profits isn’t cost-free. Companies will face additional expenses including process management, fuel changeover preparations and execution, and increased maintenance requirements.

However, by employing efficient tools like OceanScore’s Compliance Manager, companies can minimize these extra costs and operational risks while maximizing transparency throughout the compliance process.

A Strategic Shift in Perspective

What initially appeared as another regulatory burden may actually represent one of the maritime industry’s most significant profit opportunities in recent years. The key lies in understanding the compliance landscape, strategically choosing the most cost-effective pathways, and effectively managing customer relationships and contract negotiations.

For shipping companies willing to invest in proper planning and execution, FuelEU Maritime compliance could transform from a compliance headache into a competitive advantage worth hundreds of millions of euros annually.

The question isn’t whether the industry can afford to comply with FuelEU Maritime, it’s whether companies can afford to miss this unprecedented profit opportunity.