The Regulatory Landscape: Fast, Complex, and Overlapping

Regulation in maritime decarbonisation continues at unrelenting speed, and with it, the rise of maritime compliance trading. The industry is now actively managing the EU Emissions Trading System (EU ETS), grappling with FuelEU Maritime, and preparing for the potential arrival of the IMO’s Net Zero Framework.

While many in shipping had hoped for a straightforward carbon levy – if anything – regulators have instead introduced overlapping and increasingly complex frameworks. These do more than just set environmental targets. They are shaping how companies operate commercially and financially, embedding trading mechanics into the heart of maritime compliance.

Complexity That Doesn’t Scale, Especially for Smaller Players

For small and medium-sized shipping companies, the administrative and financial burden of these frameworks is significant. Navigating overlapping requirements is challenging enough. Managing compliance cost-effectively adds a whole new layer. In most cases, costs can be passed on – but only with the right strategy and execution.

And in each regulation, there’s now a new element: trade. Whether through FuelEU’s pooling system, EU ETS allowances, or the future “Surplus Units” under the IMO’s Net Zero Framework, regulators are building in mechanisms that reward overcompliance and introduce pricing signals through market forces.

Trade Is No Longer Just About Cargo

This shift means “trade” in maritime now also refers to compliance assets, and every regulation comes with its own version. Understanding and mastering these evolving trading systems is a new operational capability that shipping companies must develop. Each system has its quirks, from the relatively mature EU ETS to the still-evolving FuelEU Maritime pools.

But to function as intended, these markets need core ingredients: efficiency, liquidity, transparency, and trust.

Why Marketplaces Matter, Especially Now

Shipping has always been pragmatic. From ancient ports to modern digital solutions, the industry relies on efficient trade. Today’s compliance markets are no different – but many are not yet designed for efficiency.

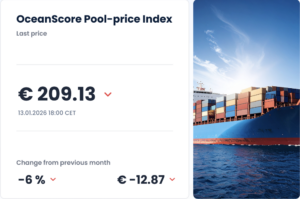

In regulated systems like the EU ETS, trading is streamlined. Prices are visible, liquidity is high, and systems are reliable. But for FuelEU Maritime’s compliance pools, the picture is different. These trades are unregulated, often opaque, and highly fragmented. Prices are hard to see. Negotiations take time. Some operators give up and choose costlier strategies. Others exploit the lack of transparency.

That’s where purpose-built marketplaces can make a difference, not as abstract platforms managed by third-party profiteers, but as practical, industry-aligned tools that simplify and de-risk compliance.

What a Maritime Compliance Marketplace Should Offer:

At OceanScore, we believe a functioning compliance marketplace must offer:

Low Transaction Costs

Pooling is simple, often little more than ticking a box in Thetis. Flexibility mechanisms are in place to handle minor surplus or shortfall in a pool. The legal frameworks for agreeing pools are increasingly standardised and easy to apply. Which is why large setup or sign-on fees, like bloated transaction charges, simply aren’t necessary.

Liquidity

There needs to be enough compliance surplus and enough compliance deficit actively looking to pool, and both must be visible. Not just vague claims or anonymous “ships on our platform.” Real, identifiable supply and demand are what make deals possible and executable.

Real Transparency

Pooling is a direct transaction between two or more DOC holders. They agree on a price and that’s it. A proper marketplace should at least provide indicative visibility into these settlement prices. Overengineered or artificial compliance indices that distort pricing don’t help; they just increase the cost of compliance.

Reliable Legal Framework

Shipping remains one of the few industries where handshake deals still mean something, where spoken agreements still carry weight. And when it comes to pooling, counterparties matter. Would you join a pool without knowing who’s on the other side? It could be a questionable entity, even a sanctioned one hidden behind an intermediary. That’s why direct pooling, without intermediaries, delivers the legal clarity and reliability shipping companies need.

This Is Only the Beginning

FuelEU is only the starting point. IMO’s Net Zero Framework is bringing even more trading mechanisms and more complexity. Now is the time to prepare and start mastering this new type of trade. The companies that do will gain not just compliance efficiency, but also commercial edge.

OceanScore: Enabling the Future of Maritime Compliance Trading

OceanScore’s Compliance Manager is already used by over 1,500 vessels daily. It powers access to maritime compliance trading opportunities across multiple frameworks, from EU ETS allowances (in collaboration with RWE, Berenberg Bank, and others) to FuelEU Maritime compliance balances.

We follow distinctly different approaches from many others out there, based on our market-leading Compliance Manager with more than 1.500 vessels using it daily. Reach out to learn how you can benefit, too.