2024 will undoubtedly be remembered as the year shipping entered the EU Emissions Trading Scheme (EU ETS), firmly establishing the era of EU ETS shipping. This bold move added yet another layer of complexity to an already highly regulated and intricate industry. Although the first year of EU ETS is not yet complete, many are already keeping March 2025 in the back of their minds, when verified MRV reports will dictate the EU Allowances (EUAs) to be surrendered. This deadline, coupled with the September 2025 EUA surrender date, leaves nine more months of uncertainty for the industry. Yet, with year-end approaching, it’s an ideal time to reflect on the lessons from this first year and prepare for the road ahead.

Lessons Learned

Data Challenges:

System Readiness and Automation Gaps

Shipping companies and verifiers faced initial struggles with system readiness for EU ETS. Even now, a lack of harmonized data formats, automation and standardized APIs results in inefficiencies. Odd errors in reporting systems and inconsistent data formats underscore the need for standardized practices across the board.

Double Charging for Data Services

A contentious issue has been the attempt by some service providers to charge shipping companies twice for their data—once for the service itself and again for sharing it via APIs. The industry has largely resisted this practice, curtailing most cases of double charging, but continued vigilance will be essential.

Discrepancies Between Commercial and MRV Voyages

Significant discrepancies between commercial voyage definitions and MRV reporting requirements have created challenges, particularly for voyage charter agreements. These differences complicate commercial settlements, as event reporting systems often fail to align data accurately in verification statements. This unresolved issue continues to hinder efficient compliance.

Technical Off-Hire Reporting

Technical off-hires need to be deducted when invoicing charterers for EUAs – EUAs caused by emissions during off-hires remain the responsibility of the owner. Off-hires though, are typically not verified, delaying negotiations and settlements. Improved reporting frameworks could help resolve these inefficiencies and support more seamless compliance.

Commercial Challenges

Transparency in Transactions

Transparency has emerged as a significant concern in managing EUAs. Invoicing for EUAs has become a labor-intensive task, with diverse format requirements, varying request frequencies, and interim statements complicating the process. Many shipping companies struggle to track whether invoices have been accepted, EUAs delivered, or payments made without a centralized system. Excel, while useful in simpler scenarios, has proven inadequate for the complexities of emissions compliance, prompting companies to seek professional solutions like OceanScore’s ETS Manager.

“As a high-quality third-party manager, transparency is at the core of how we work with our customers—no hidden charges, no hidden fees. Managing ETS exposure across multiple owners and charterers is a complex task, but OceanScore’s ETS Manager has made it efficient and straightforward. Their solution not only streamlines our processes but also helps us provide clear, transparent cost breakdowns around ETS compliance to our customers, reinforcing our commitment to trust and accountability.” – Rene Menzel, Hammonia Reederei

Shipman Clause Disputes

Shipman clauses continue to be a source of friction, particularly for non-European owners reluctant to accept responsibility for EU ETS compliance. Third-party managers thus often attempt to shift this responsibility onto owners, including the management of commercial processes, which has proven challenging. Managers, as the natural entities to handle compliance (given their MRV and FuelEU obligations), require appropriate compensation for the added workload and protection against counterparty risks to effectively manage EU ETS compliance.

Challenges with MOHAs (Monitoring Operators Holding Accounts)

Opening Monitoring Operators Holding Accounts (MOHAs) remains a significant challenge for many companies. Those without MOHAs or Union Registry Trading Accounts face inefficiencies, such as being unable to receive EUAs from charterers or purchase EUAs when needed. Vessel-specific MOHAs often create additional inefficiencies. Concerns about “contaminating” an entire fleet due to non-compliance in one vessel have proven exaggerated, and the headache of managing these multiple accounts appears to outweigh the benefits.

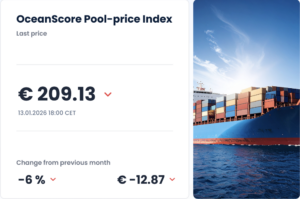

EUA Price Risks

Limited access to MOHAs and Trading Accounts could have exposed companies to significant price risks in 2024. However, the relatively low volatility of EUA prices mitigated these risks, providing some stability for companies navigating the first year of compliance.

The lessons from these challenges highlight the need for systematic, scalable solutions to manage emissions compliance effectively, ensuring long-term success under the EU ETS framework.

Looking Ahead: 2025 and Beyond

As we approach the surrender deadline for EUAs in September 2025, the following insights stand out:

Unresolved Issues Persist:

Many challenges remain, and their true impact will only become clear when EUAs must be surrendered. Temporary solutions may suffice for now, but they are not sustainable long-term.

FuelEU Will Amplify Pressure:

The introduction of FuelEU regulations will bring similar challenges, further emphasising the need for systematic solutions.

The End of Excel for Compliance Management:

Excel’s limitations are becoming increasingly apparent as companies tackle complex regulatory requirements. The continued growth in demand for OceanScore’s ETS Manager – which as of January 2025 will include and blend in FuelEU management in one platform, rebranded as the “compliance manager” – underscores the industry’s shift toward professional, scalable compliance management tools.

With over 50 customers and 1,300 vessels already using OceanScore to navigate EU ETS compliance, the growing need for robust tools is clear. Transparency, efficiency, and collaboration across stakeholders will be crucial to tackling the challenges ahead.